Special feature of 1905 film network 2021 has passed, and we will start again in 2022!

In the film list compiled by the editorial department of 1905 Film Network, you can continue to review the films that have not yet been released.(175! Please collect this list of the most noteworthy Chinese films in 2021.)In 2022, China movies will be more exciting and heavy.

Here, we carefully select and list the 200 most anticipated domestic new films this year. Which one do you want to see most?

Northeast tiger

Director: Geng Jun

Starring:Zhang Yu / Ma Li

Release time: January 14, 2022

The first good film of the new year is coming! "Northeast Tiger" won the Golden Jubilee Award as the best film at the 24th Shanghai International Film Festival, and was praised by the jury for "expressing the living conditions and yearning for the future of ordinary people with symbolic comedy techniques".

Director Geng Jun is set in a small town in the northeast with ice and snow, and Zhang Yu and Mary play a middle-aged couple caught in a marriage crisis. The film reflects the helpless fate of contemporary people with a mixture of farce and absurdity.

miracle

Director: Muye Wen

Starring:Jackson Yee /Tian Yu/Chen Halin/Qi Xi

Release time: February 1, 2022 (New Year’s Day)

Following the debut of Dying to Survive, Muye Wen’s second feature film still focuses on social reality, telling the story of a brother who organized a group of ordinary people to start a business together in Shenzhen to save his sister’s life.

In addition to Dying to Survive, Muye Wen once again proved his creative strength with the short film Escort in My People,My Country. The audience has no doubt about the quality of Miracle, but is curious about whether the film can achieve a box office miracle again. Jackson Yee, the leading actor, will have a great chance to become the first actor whose box office has broken 10 billion yuan after 00, but whether he can win the nomination of Golden Rooster Award for best actor for three years in a row or the biggest question left by the film.

Four seas

Director: Han Han

Starring: Haoran Liu/Liu Haocun/Shen Teng

Release time: February 1, 2022 (New Year’s Day)

This is Han Han’s third trip to the Spring Festival.

Judging from the current preview, the film is full of "Korean elements" — — Cold humor, racing, golden sentences … … These elements are put together, but what new chemical elements will there be this time?

As an actor, he and Shen Teng cooperated twice. I wonder if they can replicate the success of Flying Life? The addition of the new generation of actors Haoran Liu and Liu Haocun may be another surprise.

Super family

Director: Song Yang

Starring: Allen/Shen Teng/Tao Hui/Zhang Qi

Release date: February 1, 2022 (New Year’s Day)

This is the second appearance of Mahua FunAge brand after Almost A Comedy, and it is also the first time to enter the Spring Festival stalls. Director Song Yang once again cooperated with Allen and Shen Teng after The Iron Fist of Shame, and chose a fantasy theme, which is said to contain 1,700 special effects shots, creating the most investment in the history of Twist.

Zheng Qian, played by Allen, will unite his super-powerful family to confront the mayor Kichikov, played by Shen Teng. Shen Teng’s villain setting is a bit interesting, and the Northeast and Russian elements are also very brilliant.

Allen once made it clear that "containing the amount of room" is absolutely guaranteed, but Mahua FunAge, who is unstable, still has to speak with "laughter".

Snipers

Director: Zhang Yimou/Zhang Mo

Starring: Chen Yongsheng/Zhang Yu/Zhang Yi

Release time: February 1, 2022 (New Year’s Day)

"Sniper" is Zhang Yimou’s first film to enter the Spring Festival file since it was filmed. Unlike The Battle at Lake Changjin, the film chooses to see the big picture from a small perspective, and takes the "cold-shot cold-shot movement" as the story background to show the life-and-death duel between the volunteer sniper team and the American elite sniper team from a small incision.

Continuing the snow scene characteristics of On the Cliff, Lao Mouzi continues to show a large area of blank color aesthetics in the film. How to shoot intense sniper action scenes in a single scene space is the biggest attraction.

This killer is not too cold.

Director: Xing Wenxiong

Starring: Mary/Wei Xiang

Release time: February 1, 2022 (New Year’s Day)

Without looking at the comedy genre and the title, adding the word "quiet" to "this killer is not too cold" obviously has a funny meaning. Since January, Mary has continued to dominate the big screen, and Wei Xiang, the main actor of Mahua FunAge, has taken the lead in the Spring Festival for the first time.

The film is adapted from K?ki Mitani’s movie Magic Moment. The walk-on actor played by Wei Xiang meets Milan, a famous actress played by Mary. What interesting stories will happen to them in the "close encounter of mahjong" woven by the drama?

I really want to go to your world and love you

Director: Sun Lin

Starring: Zhou Yiran/Shi Baiyu/Qi Shenghan

Release date: February 14, 2022

Locked in the fantasy love sketch of Valentine’s Day, it is set that the brains of the hero and heroine are connected by an accident, which opens a wonderful synaesthesia experience, and the relationship between them has also progressed from being forced to bind to going in two directions.

Shi Baiyu and Zhou are still born after 1995. The former is named after Seeing You, and the latter participated in the drama Sky of Wind Dog Teenagers. The CP of "Mo Junjie X is strong and charming" is also a big selling point.

Ten years’ taste is as warm as words

Director: Zhao Fei

Starring: Ding Yuxi/Ren Min/Li Zefeng/Wang Chuan

Release date: February 14, 2022

Shu Haicang’s novel of the same name "Ten Years with One Taste as Warm as Words" is a "romantic novel" in the minds of many readers, which also brings pressure to adaptation.

Ding Yuxi’s reputation has soared because of "The Dark Color is Strong" and "Chen Qianqian in Rumors", while Ren Min has always been one of the most concerned post-95 florets, but after the casting exposure, the voice that is inconsistent with the original work is inevitable.

Don’t forget I love you

Director: Huang Zhenzhen

Starring: Gulnazar/Jasper Liu

Release time: February 14, 2022

"cp tonight" is two!

Judging from various materials, the cooperation between Gulnazar and Jasper Liu is full of sweetness, and this emotion has also injected expectation into this love movie. The original name of the film is Stolen Tomorrow, which is a "companion piece" of The Stolen Five Years directed by director Huang Zhenzhen.

Let love never pass the shelf life, which is everyone’s beautiful expectation for "love". The film is currently scheduled for Valentine’s Day, and it will surely be the first choice for couples to take advantage of the festive atmosphere.

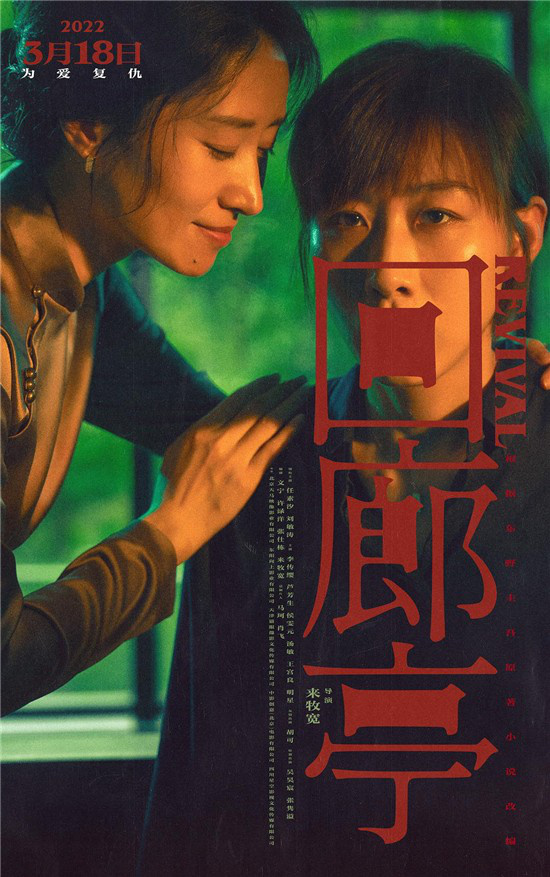

Cloister pavilion

Director: Lai Mukuan

Starring: Ren Suxi/Liu Mintao

Release time: March 18, 2022

The Cloister Pavilion is the only story in Keigo Higashino’s novels that is narrated from the perspective of women, and it has become a hot topic in domestic film and television adaptation. It not only produced a drama version, but also produced a film version.

Ren Suxi plays the lawyer who seeks the truth for love, and Liu Mintao plays the mysterious housekeeper, female+suspense. In recent years, two acting schools, which have attracted much attention from the market, have played together.

The last truth

Director: Li Taige

Starring: Huang Xiaoming/NI YAN/Tumen

Release time: April 2, 2022

This is the first time that Huang Xiaoming has served as a producer. Although the film is directed by the newcomer Li Taige, the combination of powerful actors such as Huang Xiaoming, NI YAN and Tumen, and the "secret trick" between lawyers and clients in the story is just like the title. What is the truth? Maybe we won’t know until the end of the movie.

It is worth noting that the film is the legacy of the performance artist Mr. Tu, and perhaps for those who like his performance, they will have the opportunity to feel his acting skills on the big screen again.

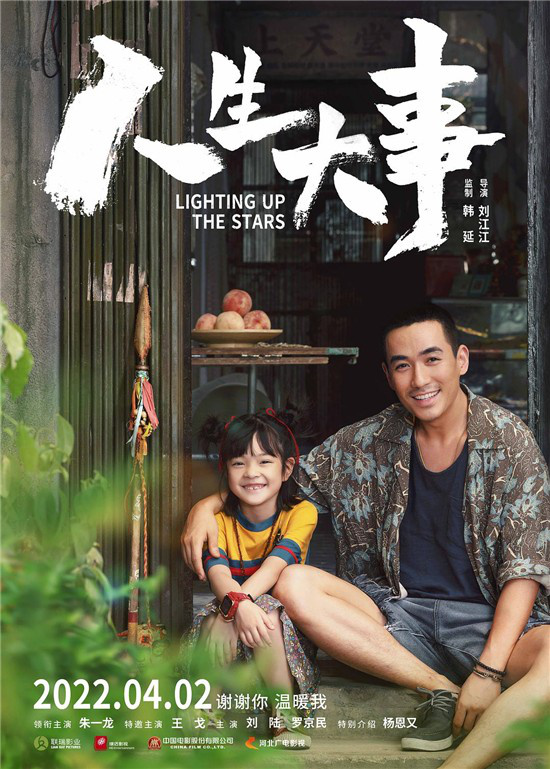

Life events

Director: Liu Jiangjiang

Starring: Zhu Yilong/Wang Ge

Release time: April 2

This is a veritable "Qingming Film", focusing on the funeral industry with rare themes, and telling the story of Zhu Yilong’s funeral master who met an orphan after he got out of prison and changed his life.

Han Yan served as producer and continued "Fuck off!"! Tumor jun: A Little Red Flower’s thoughts on death and life should be another warm healing film full of tears.

Victim

Director: Wei Xu/Wenchao He

Starring: William Feng/Tao Hong/Huang Jue/Tu Songyan

Release date: April 2, 2022

Tao Hong personally acted as the producer and starred in it, which was regarded as her comeback after many years’ absence from the big screen, and also the re-cooperation with William Feng after 14 years. Wei Xu, the director, brought a suspense crime film again after The Glacier Chasing the Murder.

The film started from a robbery and murder case, involving three parallel cases, including layers of reversal and family elements. This project won the "Most Commercial Potential Project Award" from Beijing International Film Festival Venture Capital.

Prosecutorial wind and cloud

Director: Siu Fai Mak

Starring: Johnny/Bai Baihe/Claudia/Wang Qianyuan

Release date: April 30, 2022

The film is the hottest theme in the past two years. Based on a real case, it mainly tells the story of how prosecutors acted in the fight against vice. It is the first commercial crime film focusing on prosecutors in China.

The producer of "Prosecutorial Storm" includes the Supreme People’s Procuratorate Film and Television Center, which is the first time for it to test the big screen after hit dramas such as "in the name of people" and "The Name of the Law". Director Siu Fai Mak has collaborated with Zhuang Wenqiang in Infernal Affairs and Eavesdropping.

I really hate long-distance relationships

Director: Wu Yang/Zhou Nanshen

Starring: Ren Min/Xin Yunlai/Li Xiaoqian/Chen Youwei/Zhou Yutong

Release date: May 20, 2022

The film tells the story of Zhao Yiyi finally confessing to Xu Jiashu, who has been secretly in love for many years, but by mistake, he started a long-distance relationship. How difficult it is to "long-distance love", I believe everyone who has talked about it will resonate.

The youthful romantic films of light often explode, and Xin Yunlai and Li Xiaoqian also performed well in Five Boys Who Drove the Water. Let’s keep looking forward to this work.

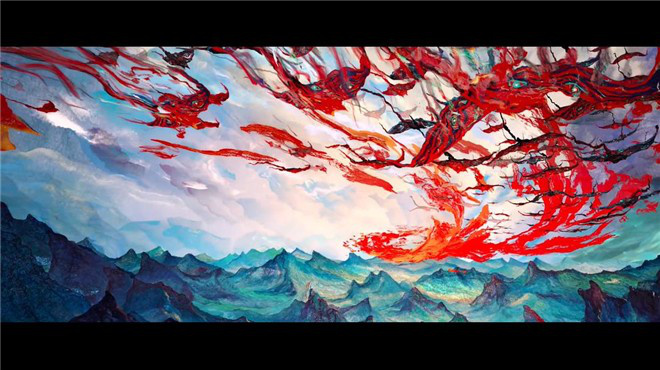

The list of new gods: Yang Jian (animation)

Director: Evonne

Release time: summer of 2022

At the end of the animated film New Gods: Nezha Reborn, Yang Jian appeared as an egg, which also led to the new list of gods: Yang Jian. It is understood that the background of the story is different from that of The Rebirth of Nezha, and the overall art will keep punk style, but it will be closer to the story dynasty.

Judging from the outline revealed so far, the story will be integrated into the plot of "Aquilaria Resinatum Saving Mother" and a new classic will be compiled. This is already the best animation creation of "light-chasing animation" at present, and I believe it will once again let the audience see the new possibilities of the country.

Watergate Bridge of Changjin Lake

Director: Chen Kaige/Lin Chaoxian/Tsui Hark

Starring: Jason Wu/Jackson Yee

The film Watergate Bridge, a sequel to The Battle at Lake Changjin, which set a new box office record in China, is coming!

The story will continue the previous plot, telling that after the battle between Xinxing Li and Xiajieyu ended, the soldiers of the Seventh Company received a more arduous task … … At the end of 2021, the main creative team reunited and made a remake. Producer Yu Dong revealed that this film will have a brand-new upgrade from story, technology to character emotion.

Nobody

Director: Cheng Er

Starring: Tony Leung Chiu Wai/YiBo

"Nobody" is the third film of Bona’s "Trilogy of China Victory" after Chinese Doctors The Battle at Lake Changjin, and it is definitely a heavy expectation in domestic blockbusters this year.

The film focuses on the hidden front during the Anti-Japanese War and tells the story of underground workers in Shanghai risking their lives to send information and defend the motherland.

Director Cheng Er once directed lethal hostage and Romantic Death History. The narrative and image aesthetic styles are unique, which deserve attention after being integrated into the commercial market elements. Tony Leung Chiu Wai will play a spy film again, partnering with the younger generation YiBo. This combination has aroused the audience’s curiosity and discussion.

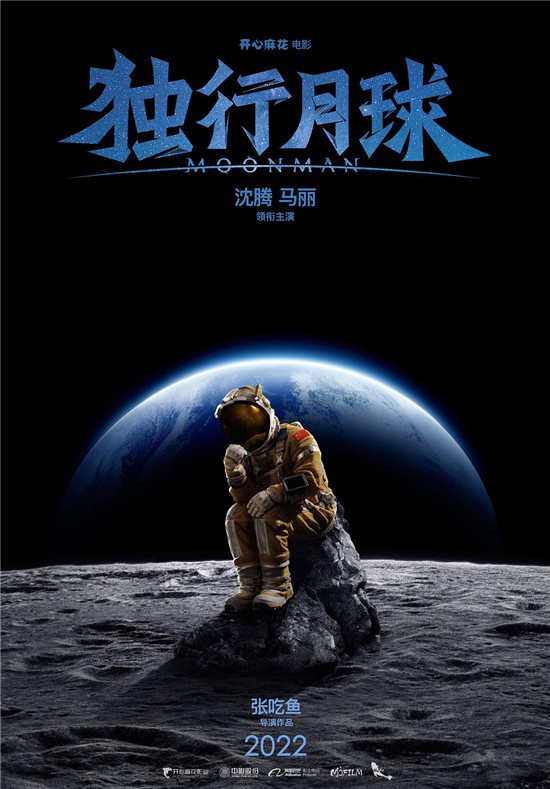

Moon Man

Director: Zhang eats fish

Starring: Shen Teng/Mary

The story of Moon Man took place in 2033. In order to resist the impact of asteroids and save the earth, human beings deployed a moon shield program on the moon. When all the staff were evacuated, the maintenance worker Du Guyue (Shen Teng) was left on the moon by the team leader Ma Lanxing (Mary).

This film is Mahua FunAge’s first attempt at industrialized sci-fi film production, and more than 90% of the shots involve special effects production. The most anticipated thing is the real cooperation between Shen Teng and Mary, the "national comedy CP" after My People My Homeland.

Haruka.

Director: Li-Na Yang

Starring: Yanshu Wu/Xi Meijuan

“— Mom! — Hey, I’m mom! — You are just like my mother. " In the preview of "Haruka", three lines of dialogue between Yanshu Wu and Xi Meijuan instantly make people cry.

This film is a rare theme of elderly women in domestic movies, focusing on the group of Alzheimer’s disease, telling the story of an 85-year-old mother taking care of her 65-year-old daughter suffering from Alzheimer’s disease alone, and continuing the mother-daughter affection and female perspective of "Spring Tide" directed by Li-Na Yang.

"Haruka" is sure to be a good movie to cry about. The cooperation between two national first-class actors, Yanshu Wu and Xi Meijuan, is also a strong contender for the best actress in domestic film festivals.

Ordinary hero

Director: Chen Guohui

Starring: Li Bingbing/William Feng/Lin Yongjian

After Hero in Fire, director Chen Guohui created the second part of the "Hero" series, and turned his attention to traffic police, flight attendants, doctors and other workers from all walks of life.

The film is based on the true story of "Rescue and treatment of a boy with a broken arm in Hetian, Xinjiang", and tells the thrilling story of a 7-year-old boy who completed emergency treatment across 1400 kilometers in eight golden hours because of his accidental broken arm.

The film is scripted by You Xiaoying, the screenwriter of Love and Love, My Sister, and starring roles such as William Feng, Li Bingbing and Lin Yongjian are to be officially announced.

Goldfinger

Director: Zhuang Wenqiang

Starring: Tony Leung Chiu Wai/Andy Lau/Charlene Choi/Yam Tat-wah

After the great success of "Warriors", Zhuang Wenqiang pursued the victory, which shows that the production scale and creative ambition of "Golden Finger" are even greater.

The theme focuses on anti-corruption and anti-corruption. Focusing on a Hong Kong listed company in the 1980s, it reveals the commercial darkness from its rise to liquidation in just a few years. It should be more artistic and contemporary than the anti-corruption storm with the same theme.

This is also the cooperation between Tony Leung Chiu Wai and Andy Lau after the Infernal Affairs series, after an interval of 18 years. It’s been a long time!

Crisis route

Director: Peng Shun

Starring: Andy Lau/Zifeng Zhang

After The Captain, another aviation film "Crisis Route" was ushered in, which turned the story perspective to the hijacking incident and told the story that Andy Lau’s father and Zifeng Zhang’s daughter joined hands to fight the robbers on the A380, the world’s largest three-story luxury passenger plane.

The filming of the A380′ s 3-story engine room at 1: 1 scale, the action drama of robbery and confrontation and the literary drama of father and daughter’s affection must be the two highlights of the film.

In Search of Lost Time

Director: Tung shing Yee

Starring: Chen Baoguo/Masu/Ayanga/Wang Qiang/Ding Chengxin.

The film is based on the real historical event of "3,000 orphans entering Inner Mongolia". Herdsmen raised these orphans in the principle of "one after another, one alive and one strong", which made a story of national unity and mutual help.

This is the first time that Tung shing Yee has filmed the theme of the main melody, and the partnership between Chen Baoguo, an old opera player, and Wang Qiang, Ding Chengxin and Ayanga, a Mongolian singer, is particularly exciting.

Don’t call me "gambler"

Director: Anthony Pun

Starring: Chow Yun Fat/Anita Yuen/Fang Zhongxin

The title reminds us naturally of Fage’s masterpiece "Gambling God" series, but this is actually a father-son film with running elements that Fage loves.

Anthony Pun, the director, was a famous photographer before, and Zhuang Wenqiang, the director of One Matchless, was the screenwriter. This is also one of the posthumous works of the late movie star Liao Qizhi.

The story tells the story of an idle braggart (Chow Yun Fat) who promised to temporarily take care of the son of his former lover Li Xi (Anita Yuen) at a price of 100,000 yuan. Later, he found out that it was his own son and he was autistic, so braggart chose to take on the responsibility of his father.

Looking at the road

Director: Hou Yong

Starring: Liu Ye/Hu Jun/Janice Man

Focusing on Mr. Chen Wangdao, the film experienced the trend of studying in Japan and Zhejiang, and was baptized by the Marxist Research Association in Yuyangli, Shanghai, and translated the first full Chinese translation of the communist party Declaration.

This is the formal cooperation between Liu Ye and Hu Jun since the 2003 TV series "Painting the Soul", which attracts people’s attention.

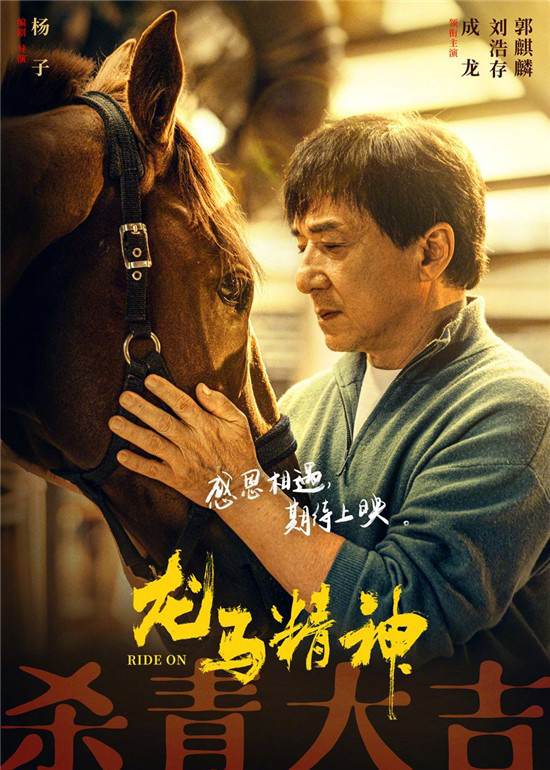

Dragon and Horse Spirit

Director: Yang Zi

Starring: Jackie Chan/Liu Haocun/Guo Qilin

The last big-screen dragon action comedy dates back to 2019′ s Detective Pu Songling.

This time, the 67-year-old Jackie Chan will play a down-and-out martial artist, who is involved in a debt dispute because he loves Ma Chitu. In desperation, he asks his daughter Xiaobao (played by Liu Haocun) and her boyfriend Naihua (played by Guo Qilin) for help. In the road of three people and one horse to save themselves, many jokes have been made.

Yang Zi, the director who once filmed "Pet", is good at shooting animals. Another significance of the film is to pay tribute to the action actors of the Dragon and Tiger Martial Arts.

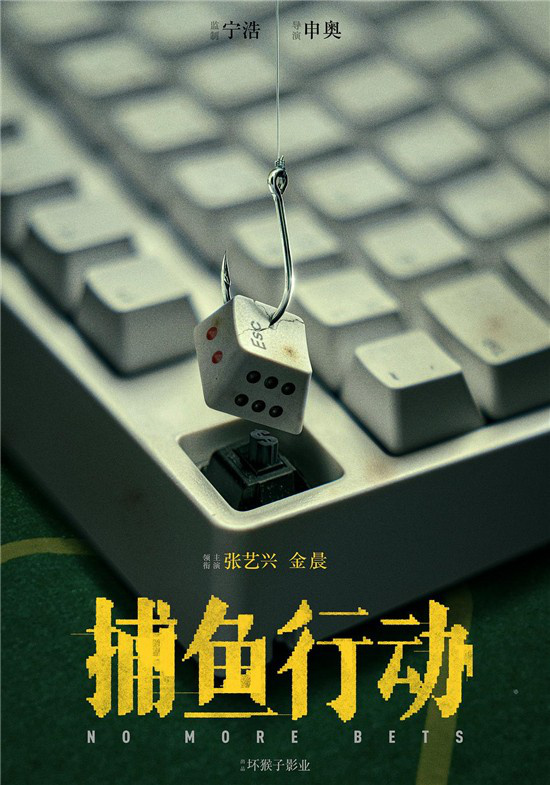

Fishing action

Director: Olympic bid

Starring: LAY/Gina

"Beneficiary" director’s bid for the Olympic Games has attracted the attention of the industry since winning the Golden Rooster Award for best debut. The new work "Fishing Action" takes anti-fraud as the theme and keeps up with current social events.

It is reported that LAY will play the role of programmer and Gina will play the role of model, and they are accidentally involved in an online scam. Ning Hao is the producer, escorting the Olympic bid, and the quality is basically guaranteed.

Wash in vain

Director: Dapeng

Starring: Dapeng/Li Xueqin

After The Reunions was well received, Dapeng returned to direct comedies, and the topics discussed were more serious — — Cyber violence.

The film tells the story of a middle-aged man who became a cemetery salesman and his clients were involved in a peach rumor storm. He tried his best to "whitewash" his clients and made many jokes.

Since Pancake Man, Dapeng, as a director, has become more and more mature in his creation. What sparks will collide with Li Xueqin, the talk show queen?

fertile ground

Director: Wang Xiaoshuai

Starring: Yongmei/Zu Feng

Judging from the theme and lineup, "fertile soil" will aim at major international film festivals. This is the second part of Wang Xiaoshuai’s "Hometown Trilogy" after "Auld Lang Syne", which tells the changes of family life of three generations of grandparents and grandchildren and will show the map of the relationship between people and land in China.

Yongmei will be a guest star with Zu Feng and Wang Jingchun. Although the film is a realistic theme, it is said that there are a lot of special effects shots, and the post-production time is relatively long. Is it expected to catch up with the Berlin Film Festival at the beginning of the year?

Angel of War & Assassination Storm & Pursuit of the Jedi & Anti-drug in 3 Days.

Director: Qiu Litao

Qiu Litao’s filming speed is never disappointing. At present, he has finished filming, and there are four films waiting to be released after post-production, including War Angel, Assassination Storm, Jedi Pursuit and Anti-drug for 3 Days.

Assassination Storm, Pursuit of the Jedi and Anti-drug 3 Days are all Qiu Litao’s works on criminal action which have been well received by the audience in the mainland market in recent years. Among them, Anti-drug 3 continues the theme of this series. As for the main creation, Liu Qingyun, Louis Koo and Aaron Kwok were invited this time. I believe that these elements together are worth leaving a movie ticket for him.

The story told in "Pursuit of the Jedi" is not difficult for Qiu Litao, but it is rare to have deep cooperation with mainland actors in this cast. I wonder what new sparks will there be in creation?

After "Anti-drug 2" Shock Wave 2 series, Andy Lau and Qiu Litao cooperated again to shoot this work related to the epidemic. Although it is difficult to give Qiu Litao an absolute definition of genre, there will be some unexpected surprises when he directs such stories.

Besieged city of Kowloon walled city

Director: Zheng Baorui

Starring: Louis Koo/Sammo Hung/Richie Jen

Zheng Baorui finally started the series of "Kowloon Castle" which has been prepared for many years, and the production team is also very strong.

His previous work "Wisdom Teeth" showed his superb scheduling ability in constructing rendering scenes and image worlds. This time, it will reshape Kowloon Castle, an important cultural and historical symbol of Hong Kong, which is more difficult, but also has more room to play. Just looking at this theme and cast will raise the expectation value.

Escape from youth

Director: Hairuo Zeng

Starring: Shawn/Chunxia

Producer Rao Xiaozhi, starring Shawn and Chun Xia, this configuration inevitably makes the audience curious.

The story of the film is very novel, telling the story of a programmer’s paranoia and behavior that disturbed the company’s financing plan and was sent to the "youth" mental rehabilitation hospital by the company. The people and things he met here gave him a new understanding of everything.

It inevitably reminds the audience that Rao Xiaozhi’s debut novel Hello, Crazy, and similarly, other actors are deeply involved in the drama stage this time. I wonder what special sparks they will have when they "break into" the big screen this time.

Looking for her

Director: Chen Shizhong

Starring: Shu Qi/Ke Bai

Unexpectedly, this young male director’s first film turned out to be a story about women seeking self-awakening. Not only that, but the film also features Shu Qi and Ke Bai, which can be described as a very strong lineup.

This is the second time that Shu Qi performed a film in Cantonese after many years, while Ke Bai, a native of Shandong Province, studied dialect hard for this reason and used Cantonese at the same time during the performance. Zhang Benyu came to the shooting place one month in advance to experience life, and finally even integrated into it, and was mistaken for a local.

The woman played by Shu Qi is a farmer who grows sugar cane. In order to have a more realistic effect, the movie starts at the time of waiting for the fruit period of sugar cane, and it is more sincere than the growth rate of sugar cane during filming.

I passed the storm

Director: Qin Haiyan

Starring: Tong Liya/Wu Yuhan

Tong Liya’s I Through the Storm is the first anti-domestic violence film in China, directed by Qin Haiyan, the screenwriter of Finding You. Previously, it was revealed that the film was scheduled to be released in the first half of 2022.

"Domestic Violence", "Feminism" and "Tong Liya’s Big Girl Plays" have multiple topics, which will surely arouse a lot of discussion after its release.

Lost in the Stars

Director: Liu Xiang

Starring: Zhu Yilong/NiNi/Janice Man

The film Disappeared She is adapted from the classic film Gone Girl directed by David Finch.

Perhaps for many viewers, adaptation is the original sin. It is worth noting, however, that the team of this film is the creative team that has successfully operated the Sheep Without A Shepherd series of films, and has strong experience in film adaptation. The audience can believe that this film will have a more grounded creation in terms of localization.

Deep sea (animation)

Director: Tian Xiaopeng

The film appeared as an egg at the end of Legend of Deification’s film, which attracted many audiences’ expectations.

From the preview, the painting style of this film is different from Tian Xiaopeng’s previous work "The Return of the Great Sage", which depicts an imaginative scene with a more childlike brush.

Deep Sea will be an animated film with sci-fi theme. If every director has a work that he wants to do all his life, Deep Sea is like this for Tian Xiaopeng. He has revealed that this story has been conceived in his mind for many years, and even in his early years, his Weibo name was "Deep Sea Alien".

Love is delicious

Director: Chen Zhengdao/Zhaoren Xu

Starring: Chun Li/Baby Zhang/Naomi

The second season of the long-awaited drama "Love is delicious" didn’t come, but the film version of "Love is delicious" took the lead in the preparatory period.

It is understood that in addition to the return of the original crew of the series, this film will continue the series "Love is delicious", but it is not an absolute ending, and it will still be various stories encountered by three women in love and work. Just from the drama volume to the film volume, I wonder what the screenwriter will hand over?

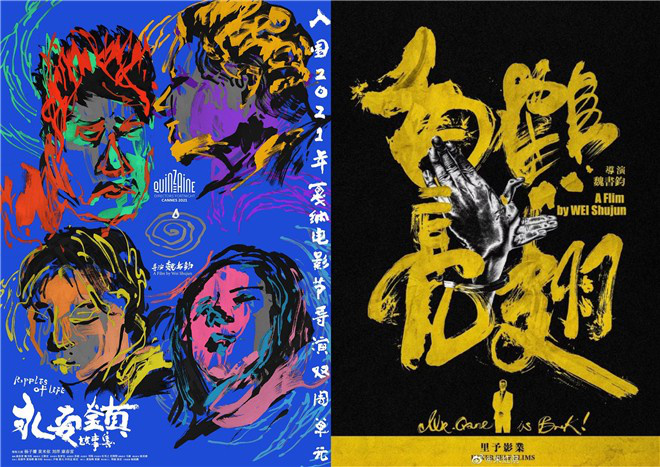

Stories of Yong ‘an Town & White Crane with Bright Wings

Director: Wei Shujun

Wei Shujun, who entered Cannes three times, is a potential stock of young directors in China. In recent years, he has produced a lot of works, and there are currently two new films in hand.

The Story Collection of Yong ‘an Town tells the story of making a film in three parts, from Cannes to Pingyao to Golden Rooster Film Festival. It has a good reputation, with Douban scoring 8, and Wei Shujun also won the honor of best director at Pingyao Film Festival for this film.

The White Crane with Bright Wings, which he is filming, will focus on the emotion between father and son. It is said that Jackson Yee and Wang Jingchun are the leading actors, and the lineup is eye-catching. Different from Wild Horses Divide Their Manes and Tales of Yong ‘an Town, the creation of White Crane with Bright Wings will have less personal life experience of the director.

The spectator

Director: Sonthar Gyal

Starring: Chen Kun/Yanhui Wang/Liu Mintao

Director Sonthar Gyal’s new film continues the discussion on the relationship between father and son in "The Color of Ala Ginger", but this time, instead of using Tibetan, he is not a Tibetan actor, but shooting across the context and inviting Chen Kun to lead the starring role.

Chen Jiahui, played by Chen Kun, went back to his hometown to visit his seriously ill father after many years. After his father passed away, the three brothers and sisters reunited in their old house, and the accumulated misunderstandings and regrets were spread out again.

Judging from the theme and story, we can think of Hirokazu Koreeda’s family films. Chen Kun, who has been immersed in the world of costume films, has finally performed a realistic literary film, which is expected.

Above the clouds

Director: Liu Zhihai

Starring: Chen Weixin/Wu Jiahui

This is a film created by teachers and students of China Academy of Fine Arts. Last year, it won the Tiantan Award for Best Film, Best Actor and Best Photography at the Beijing International Film Festival.

The film presents a story of "quite marching" in 1935 with ink color and experimental techniques, with a large number of long shots and unique style. The director said that "freehand brushwork, cruelty, survival and death" are the aesthetic concepts pursued by the film. Art film lovers should not miss it.

One and four

Director: kumei in a row

Starring: Kimba/Wang Zheng

Director Kumeji is only 24 years old, and his graduation work One and Four was shortlisted in the main competition unit of Tokyo International Film Festival last year.

The story takes place in the snowfield of Linhai, where a forest ranger and three uninvited guests are involved in a pursuit case, which combines the elements of the west, police and bandits and suspense. It is reported that the film has a "Rashomon"-like narrative structure.

After The Uninvited Guest and Make a Famous Name, we will see another movie with similar concepts of "script killing" and "werewolf killing".

Critical point of anti-gang action

Director: Lin Delu

Starring: Amanda/Zhou Yiwei/Ceng Zhiwei

The series of directors of "Anti-Corruption Storm" marched into the mainland to create a blockbuster movie with the theme of eliminating evils. The film was adapted from a real case provided by the Central Political and Legal Committee, telling stories about political and legal police officers and heroes, and showing the country’s determination and confidence in "eliminating evils". It is worth mentioning that Ng Man Tat made a guest appearance in this film before his death.

Sweep the evil out of the clouds and see the sun.

Director: 500

After the popularity of "Black Storm", director Wu Bai will also direct cinema films with similar themes. Is it a movie version of "Black Storm" or a new creation? Will Sun Honglei, the leading actor, join the film? Everything has yet to be officially announced.

From "Decisive Battle against the Smuggling" and "The Critical Point of the Smuggling Action" to this one, there is no doubt that "the craze against the Smuggling" has been rolled up on the domestic big screen in recent years.

Look at a bridge

Director: Song Xinqi

Starring: Kara Wai/Hu Xianxu

"Look at a Bridge" is adapted from Douban’s novel "Dog Man 200 Days", which tells a warm and healing story about a retired bridge engineer played by Kara Wai and problem of juvenile played by Hu Xianxu who got to know each other because of a cross-provincial driving trip.

This new director project was shortlisted for the venture capital unit in Beijing International Film Festival. Although it is small, it still brings together three generations of actors, including the old, the middle-aged and the young, and the types of road films are also interesting.

Screenshot of filing project

Hedgehog

Director: Gu Changwei

Starring: Ge You/Karry

After "Little Love" and "It’s good to meet you", director Gu Changwei finally returned to serious subjects. The film is adapted from Zheng Zhi’s short story "Fairy Disease", one of the "Three Masters of the Northeast Renaissance", which tells the deep story of a naive psychopath and a depressed teenager redeeming each other.

In addition to the great expectation of Gu Changwei’s return, the combination of "Ge You+Karry" is also quite interesting.

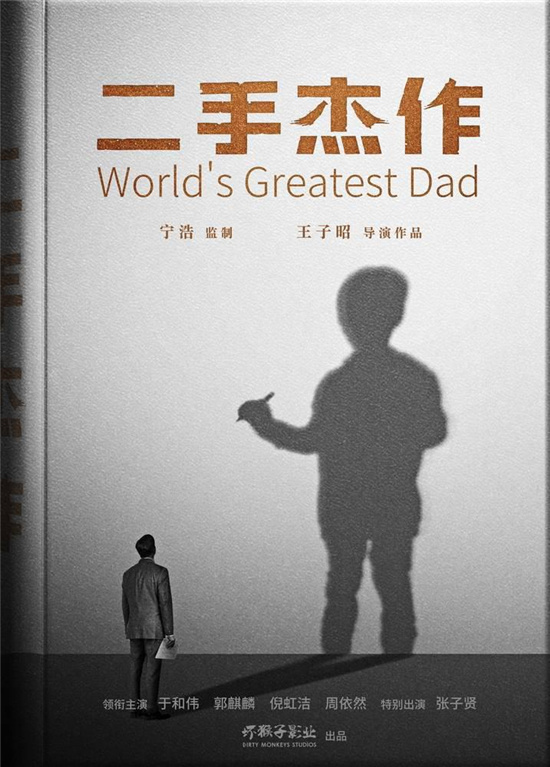

Second hand masterpiece

Director: Wang Zizhao

Starring: Yu Hewei/Guo Qilin/Ni Hongjie

Ning Hao’s "Bad Monkey 72 Movie Project" will bring a new director’s second-hand masterpiece.

The film focuses on the affection between father and son, and Yu Hewei and Guo Qilin play the role of father and son. The father is a Chinese teacher and the son is a waste wood student, and Xú Zhēng and Li Chengru also join in it. It is a comedy that shows the true nature of existence in black humor.

Become a winner

Director: Pengyuan Ren

Starring: Jerry Lee/Celina Jade/Tu Songyan

After the previous work "The Player Behind the Scene", Pengyuan Ren once again cooperated with Xú Zhēng, but this time Xú Zhēng only participated as a producer. The film, starring Jerry Lee and Celina Jade, tells the story of the showdown between ordinary grassroots and behind-the-scenes capital in the commercial struggle.

From the outline, the film seems to continue the story style of "The Player Behind the Scene". At the beginning of the project, the film was named "The Winner Behind the Scene". I think this work will be inextricably linked with the previous work to some extent.

Under the Alien

Director: Wu Ershan

Starring: Hu Xianxu/Vanda Lee

The much-watched Trilogy of Gods has not been released for a long time, and director Wu Ershan has devoted himself to the adaptation and creation of another fantasy IP work Under the Aliens, which, like the previous one, will also be a trilogy series. It seems that Wu Ershan is going to be the first person in China fantasy movies.

The film has been turned on at present, and there are many photos of Reuters on the Internet. Hu Xianxu, an actor, lost more than ten kilograms in exercise to get close to his role. Compared with the male host, Feng Baobao, the heroine with strange personality and distinctive acting style, is the most concerned by many original fans. The role was played by the new actor Vanda Lee. Before that, she had starred in "Birds Singing" directed by Tian Zhuangzhuang. At the same time, as a new actress signed by director Wang Jiawei, she believed that she would have a special movie charm.

Drug hunting

Director: Gao Zibin

Starring: Andy/Wang Qianyuan/Shang Yuxian/Liu Mintao

Andy, a female anti-drug policeman, performs undercover task for the first time, disguises as female drug traffickers, sneaks into a drug trafficking group, and fights wits with Liu Xingjie, a drug dealer played by Wang Qianyuan.

The producer of the film is Qiu Litao, the director and Gu Yufen, the producer of "Anti-drug 2" Shock Wave 2 who worked with Andy Lau.

Punch, mom

Director: Tang Xiaobai

Starring: Tan Zhuo/Tian Yu/Tian Hairong

In the play, Tan Zhuo plays a single mother who has been betrayed in her career. After experiencing the darkest moments of her life, such as the death of her parents and the separation of mother and child, she tries her best to regain her life.

Punch, Mom, it’s easy to think of Wrestling! Dad is a sports+female theme film which is scarce in the Chinese language market. The boxing action scenes in the film are all done by Tan Zhuo herself, and she has undergone more than half a year’s rigorous training.

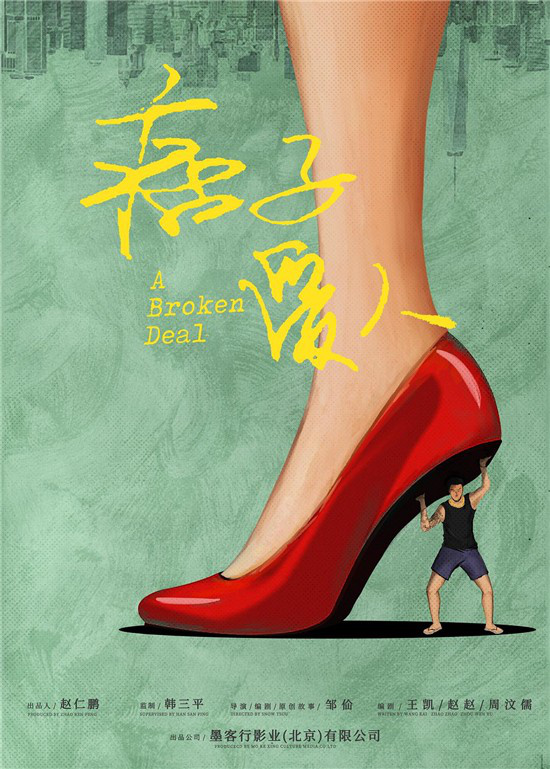

Love of riffraff

Director: snow zou

Starring: Shu Qi/Zhou Yiwei/Jung Erjia

In 2017, during the period of The Birth of Actor, Shu Qi once wrote that the film "The Ruffian Lover" co-produced by Zhou Yiwei was launched two years later. Now, two years later, the film has not been released.

The film is produced by Han Sanping, and tells the story that Yin Hao, a little rascal played by Zhou Yiwei, becomes the bodyguard of Jin Ling Heng Jie (Shu Qi) who is "divorced and unemployed" and raises his son alone. Two people with different backgrounds, different personalities and different ages develop a love story in the constant conflict of jokes.

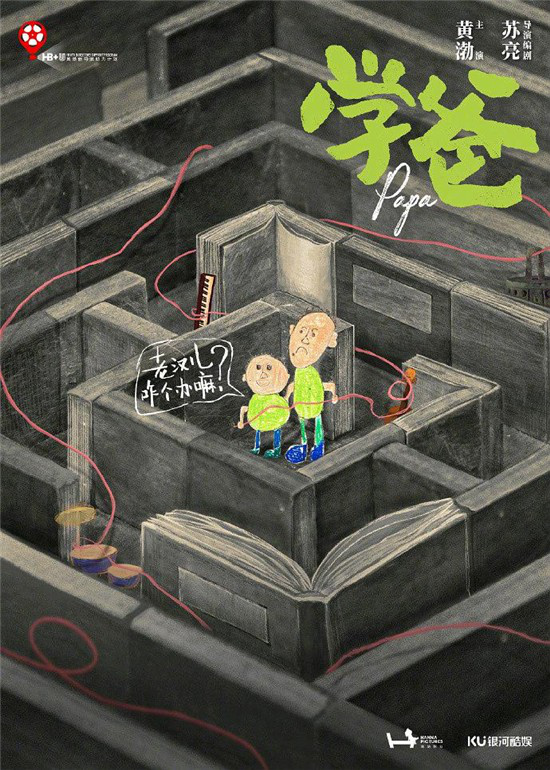

Learn from dad

Director: Su Liang

Starring: Bo Huang/Zhang Xiaofei/Leo/Zhang Zixian

"Learning Dad" tells the story of Bo Huang’s father, Lei Dali, who took care of his eldest son Xiaomi alone after his wife’s death. Facing his grandfather’s request, Xiaomi must be admitted to the best primary school, or he will be taken to study abroad. Lei tried his best, only to find that parents had already "scrambled".

"Learning Dad" focuses on the hot educational topics such as "Young to Young" and "Chicken Baby", and it is also the first commercial comedy of the "HB+U" new director assistance program initiated by Bo Huang. The cooperation between Bo Huang and Zhang Xiaofei, the best actress of the new Golden Rooster, is even more exciting.

Reindeer

Director: Kang Bo

Starring: Hugh/Vicky Chen

The story tells the story that Zhu Shaoyu, a newly released trafficker, was accidentally involved in the process of the police cracking a human trafficking case across the Northeast, confronted with the past of sin and was redeemed.

Hugh plays this Zhu Shaoyu, who is called "Reindeer". He is both a trafficker and the father of the child, and his character psychology is very complicated. This is also the time when Hugh once again appeared in a crime film after The Party at South Station. This film was finished in Mudanjiang in February 2021.

Love history of three nobles

Director: Liu Siyi

Starring: Hu Xianxu/Yao Chen/Zhou Ye

The story can be called "The Sleeping Curse for Men", which originated from a gambling agreement between male and female gods. Wang Sangui, a boy on earth, had an odd curse: everything he kissed immediately fell asleep, except true love. In order to break the curse, Sangui embarked on a growing journey to find true love.

The film was produced by Li Shaohong and co-produced by Yao Chen. It won the top five winning projects in the fourth "Green Onion Project" and was completed in March 2021.

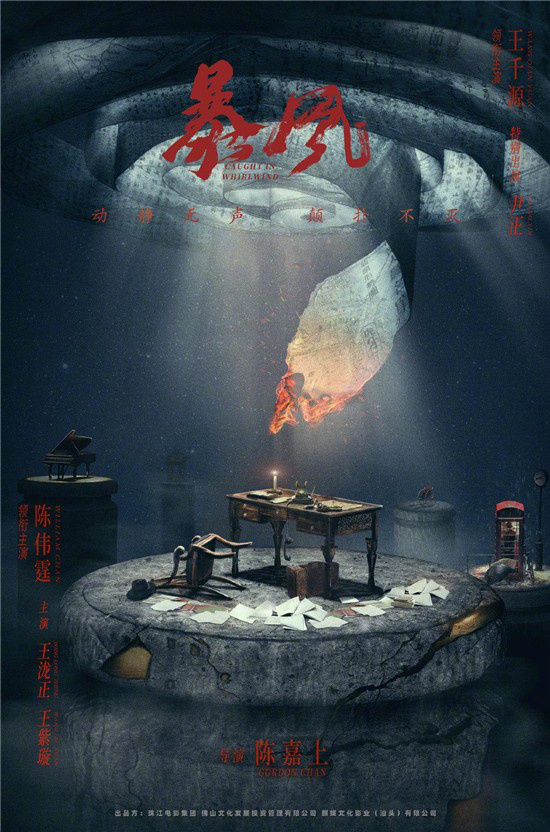

Storm

Director: Chen Jiashang

Starring: William Chan/Wang Qianyuan/Wang Longzheng

"Storm" is a red-themed film that combines elements of spy war, action, gun battle and other commercial types, with the real history of Shantou secret traffic station as the story background, and will also present the characteristic history and folk culture of the old Chaoshan.

The film was finished in June, 2021. This is the first theme work starring William Chan, and it is also expected to play opposite Wang Qianyuan.

I want to see you

Director: Huang Tianren

Starring: Alice Ko/Greg Han Hsu/Shi Baiyu

The phenomenon drama "I want to see you" has been broadcast for more than two years, and the "Fengnan Team" has been sold continuously, and the audience has also ushered in a movie version.

The director, screenwriter and starring are all original people, which ensures the original flavor. The eggs in the drama version of "I want to see you" will become the wedge of the film version. Huang Yuxuan and Li Ziwei may once again fall into the love cycle of Mobius.

The film "I want to see you" once appeared in the annual list of Wanda Film and Television in 2021-2022, and was interrupted due to the epidemic. Some Taiwanese media reported that the film was finished in October 2021 and will meet the audience soon.

once a thief

Director: Jing Wong

It is understood that Jing Wong’s classic Hong Kong drama "Crossing the Seas" will be re-adapted into a film after more than 20 years, directed by Jing Wong himself.

The original version tells the grievances of a wealthy family, and the film version will integrate various elements of plot, comedy, action and crime. The specific information needs to be officially announced.

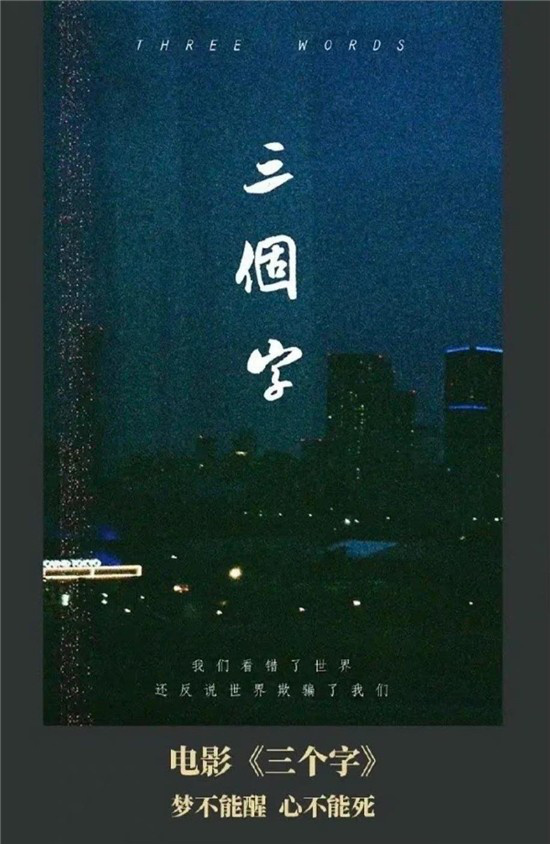

Lou Ye’s Unnamed New Film

Director: Lou Ye

After "Lanxin Grand Theatre", Lou Ye also made new moves. It is reported that the new film project is tentatively named "Three Characters". According to the introduction of the project, it tells a story in memory, about the love that lacks courage and the vitality of friends struggling with fate.

It is rumored that this film will be like "A Cloud Made of a Rain in the Wind" and "Lanxin Grand Theatre", with actors who are very popular in the market.