Consumers who pay attention to protecting personal rights and interests can hardly miss the annual "Spring Festival Evening"-315 party.

However, from the moment the TV is turned on, the rights and interests of about 300 million consumers in the country have been infringed-dozens of seconds of on-off advertisements.

This is a long-standing "stubborn disease" in the smart TV industry, but there is a trend that bad money drives out good money, and manufacturers "fall" one by one. Not only on the "315" Rights Protection Day, in the past days, many consumers have continued to complain.

"Watching TV was originally relaxing. As a result, I watched the advertisement first, and I couldn’t turn it off. I escaped the advertisement of the mobile APP, but I couldn’t hide here. What is even more frightening is that the advertisement is getting longer and longer. At first, it takes more than ten seconds, and then it takes dozens of seconds and one minute. At this time, a sprint race may be over. "

On the social media platform, consumers can often see all kinds of complaints about smart TV on-off advertisements: whether it is sports fans who are anxious to watch the live broadcast of the game, children who are waiting to watch cartoons, or middle-aged and elderly users who are not familiar with the network, the bad experience that on-off advertisements can’t be skipped is a refreshing of the lower limit of endurance again and again.

No wonder, some people miss the old TV in the past, and they can turn it on and off with one click.

Smart TV, which integrates the rich content of the Internet, should not be so complicated, let alone make people wait too long.

It’s International Consumer Rights Day on March 15th, and the theme of this CCTV 3.15th party is "Fair, Honest and Safe Consumption", that is, fair, reasonable, equal and safe consumption. On-off advertising allows consumers to passively accept what they don’t want to see, which is contrary to fairness and integrity, and it doesn’t matter if they feel at ease.

On-off advertising, why become the "psoriasis" of smart TV?

Before the popularity of smart TV, the boot mode in our memory is very simple and rude. Pick up the remote control on the coffee table and you can boot it with one button.

But in the era of smart TV, after some TVs are turned on, it is not TV programs that jump out, but advertising content ranging from a few seconds to dozens of seconds. When the user just found the button to turn off the advertisement, the advertisement was finished.

Smart TV manufacturers have earned another advertising click fee. For the audience, the so-called intelligent technology did not bring the beautiful experience it deserved.

On a consumer service platform, key words such as "TV, startup advertisement" were entered, and 172 results were found.

Some users said that after buying the TV at first, it was a one-button switch, and there was no advertisement; After a few months, TV not only suddenly extended the on-off time, but also appeared a 15-second on-off advertisement.

In addition, some consumers complain that on-off advertising seems to have an extended trend. "I endured it in the first 10 seconds, but now it’s 15 seconds to 20 seconds. Every time I turn it on and off, it’s like being forced to watch an advertisement, which is getting more and more annoying."

In fact, before users buy smart TVs, some salespeople are reluctant to take the initiative to tell the system to pre-install information such as "on-off advertising" in order to sell products. Some manufacturers responded after receiving consumer complaints, and the on-off advertisement was pre-installed in the system and could not be cancelled.

Article 44 of the Advertising Law clearly states: "Publishing and sending advertisements through the Internet shall not affect users’ normal use of the Internet. Advertisements published in the form of pop-ups on Internet pages should be clearly marked with a closing sign to ensure one-click closure. "

But the reality is that users have searched for a long time in the system settings, but they have not found the function of closing advertisements.

Some consumers even said that a lot of advertising information is extremely misleading. "The information conveyed by many on-off advertisements doesn’t seem to be very reliable", which is easy to fall into the "trap" of on-off advertisements for some elderly viewers with weak awareness of prevention, who have just left the exaggerated TV shopping bombing of traditional TV.

The negative impact of on-off advertising can be small, but in any case, it should not be the reason for consumers to resist smart TV, nor can it become an obstacle to the orderly and healthy development of smart TV industry. The reason behind this "psoriasis", which has been repeatedly concerned by the regulatory authorities and repeatedly exposed by authoritative media, lies in the high advertising profits.

Manufacturers earn 2.6 billion advertising fees a year, and consumers are "bonus hunter"

With the rich Internet content ecology and the massive investment of technology companies, the smart TV market has maintained rapid growth.

At present, the number of domestic smart TV users has exceeded 300 million, and it has a tendency to continue to expand. Smart TV has long been a regular item at home.

In the early days when the Internet invaded traditional industries, it was often necessary to capture a large number of users through lower prices. As a result of price reduction, consumers have made a profit on the price, but relatively speaking, the profits of manufacturers have changed from thick to thin.

The so-called "wool is on the sheep", and the profit has become thinner. Where can we make up for it? As a result, "on-off advertising" was targeted in this way. What’s more, individual manufacturers have embedded advertisements in the dazzling TV UI interface.

According to statistics, the scale of domestic Internet advertising was close to 550 billion yuan last year, and system advertising, including on-off advertising, could bring 2.6 billion yuan in revenue to related manufacturers.

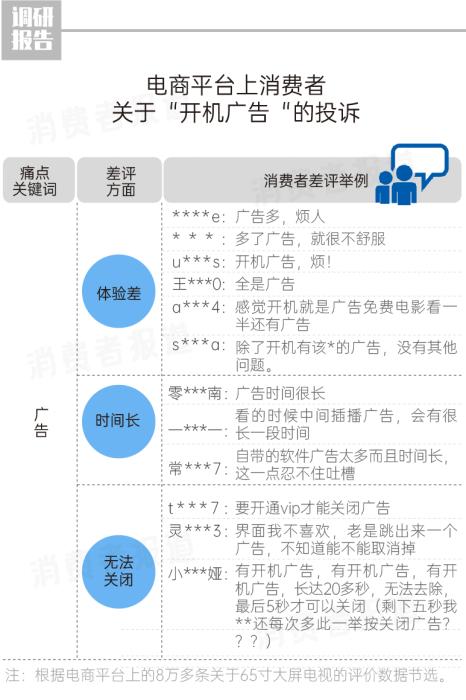

In October 2021, the "Pain Point Report of Big Screen TV" released by consumer reports showed that on-off advertising has become the "number one pain point" for consumers. Regarding the bad reviews of advertisements, consumers focus on three aspects: poor experience, long time and inability to close. Of all the domestic and foreign TV manufacturers surveyed, only Samsung, Panasonic, Sony, Glory and LG have no advertisements.

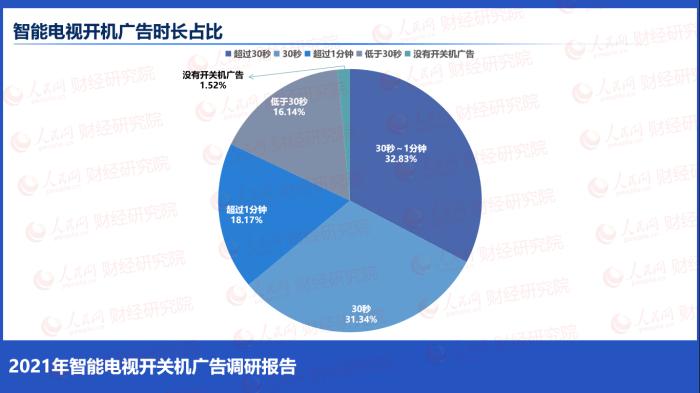

Then, the People’s Network Finance and Economics Research Institute released the "Research Report on On-Off Advertising of Smart TV in 2021". Relevant data also pointed out that advertising has seriously affected the consumer experience. More than 89.9% of the respondents said that their smart TVs contained "on-off advertisements", while only 10% did not.

86.1% of the manufacturers did not set the "one-button cancel/close button" for on-off advertising; 84.9% of the respondents only advertised the existing switch-on and switch-off when they used it, and only 9.6% of the respondents knew it before buying it.

It is worth mentioning that the data shows that the five most important items for respondents to choose smart TV are image quality, price, after-sales service, whether there are on-off advertisements and sound quality, accounting for 85.3%, 72.2%, 59.1%, 55.6% and 49.5% respectively. Whether there are on-off advertisements has become a very important factor for consumers to choose products.

This mode of making money is a "bonus hunter" from consumers, which not only damages consumers’ experience of watching TV, but also allows pervasive advertisements to break into family space.

Distorted profit model, while trampling on consumers’ rights and interests, does not forget to pour "cheap" dirty water on consumers. In fact, without discussing the high-priced products of Sony and other manufacturers, the price of glory smart screen without advertising is lower, and it has won many times in the objective evaluation of scientific and technological media.

Manufacturers can’t be "fair and upright", how can consumers "consume with peace of mind"?

According to the latest data released by Aoweiyun. com, in February this year, the scale of online retail sales of color TVs decreased by 17.6% year-on-year.

There are many reasons for the decline in smart TV sales, but the bad experience is not innocent, including on-off advertising.

As a product whose right to use has completely belonged to consumers, it is up to consumers to decide what to see, what to experience, and whether there can be on-off advertisements.

Science and technology are good, and the initial heart of TV practitioners cannot be changed.

The change of science and technology has produced more cool products, but the service and experience have not changed with it. When TV manufacturers only pay attention to the profit of technology and ignore the user experience, technology loses its initial intention of creating a better life.

Consumers will eventually vote with money, support products that pay more attention to user experience, and let good money drive out bad money.

On the other hand, in the domestic TV industry, we need manufacturers like Glory to dare to break the chaos in the industry and "run backwards".

In an exclusive interview with the people’s living room last year, Zhao Ming, CEO of Glory, said, "We are the first enterprise in China to put forward the idea of switching on and off without advertisements, and we are also one of the manufacturers that still insist on switching on and off the smart screen without advertisements. The core value of our enterprise is to take consumers as the center." Impressed many people.

It is not easy to insist on no-switch advertising. On-off advertising chaos has been repeatedly banned because it has indeed brought many benefits to many manufacturers. On the other hand, glory, "I will never move", from the creation of the smart screen category in 2019 to the present, I have been practicing the concept of "no advertising on and off".

For example, the X2 series of Glory Smart Screen released in September last year, in addition to continuing the feature of no advertisement on and off, has also performed well in terms of product strength such as sound quality, multi-screen collaboration and smart interconnection.

Good products can talk. At the 7th Responsible Consumption Forum, Glory Smart Screen won the "2021 Responsible Product Award" as a new product in the industry with its "customer first" values, excellent technical level and product quality.

The so-called responsible consumption means that consumers should make their consumption behavior have a positive impact on their future lives and adopt a "responsible" attitude in the process of consumption, so as to promote production and provide products that are more in line with the health and long-term development of the industry. Obviously, the screen of glory and wisdom can afford it.

As a pioneer who leads the trend of no advertising in the industry and a fellow traveler who thinks about consumers, turning on and off the glory smart screen without advertising is only the first step to be fair and upright, so that consumers can spend with peace of mind and promote the improvement of science and technology, and more TV manufacturers need to participate in it. The road ahead is long and there is a long way to go.

Who’s Cleming?

Who’s Cleming?