Editor’s Note: This article comes from WeChat WeChat official account "Spirit Beast" (ID:lingshouke), by Dust, published by 36Kr with authorization.

I didn’t expect "celebrating the New Year on the spot" to add another fire to the self-heating food market.

On January 20, 2021, on the day of a well-known e-commerce New Year Festival, 200,000 people placed an order for self-heating hot pot-this figure is 10 times that of the same period last year. Compared with the situation that self-heated food was robbed last year, consumers may be more worried about "which one to choose" this year.

Up to now, hundreds of brands have poured into the "self-heating" food track. In addition to new brands such as Mo Xiaoxian and Zi Hei Pot, which focus on self-heating food, leisure food enterprises such as Uni-President, Master Kong, Liangpin Shop and Three Squirrels have increased their prices, and offline hot pot brands such as Haidilao and Xiaolongkan are also one of the main forces of self-heating hot pot.

And new players are constantly entering this track. For example, Yang Guofu, an offline Mala Tang chain brand of "self-heating Mala Tang Hotpot", was recently launched, and its products have been launched on the e-commerce platform. However, Yang Guofu does not have an advantage in online operation, product features and pricing. It is still unknown whether the "cross-border" of offline stores can tear open the self-heating hot pot market.

In the past two years, every time self-heated food is pushed to the forefront, it is always accompanied by abnormal events such as epidemic situation and Chinese New Year. But in fact, there is still a large market "Red Sea" to be developed for self-heating food in outdoor, school and other scenes and sinking markets.

However, self-heating food is only a branch of instant food. With the congestion of the original track and the attack of semi-finished products, instant noodles and takeout, how can new players open up the market in the future, and when will weak players be eliminated, which is more interesting.

"I bought several brands of self-heating hot pot and rice from the Internet. Before the year, the price of vegetables and meat was expensive, and some convenient food could be prepared for emergencies." Zhao Man, who stayed in Beijing for the New Year because of the epidemic, said.

When the year ended, the epidemic came again, and the scene that convenience foods were snapped up a year ago seemed to leave an impression. What is different this year is that the number of "preparing for war" enterprises has increased significantly, and many brands have "broken their hearts" for how to eat well.

According to Taobao statistics, the number of brands of "instant hot pot" and "instant rice" on Taobao and Tmall channels has exceeded 1,000, accounting for nearly one-seventh of the whole instant vegetarian industry.

The latest research by Mintel shows that the market share of self-heating foods in convenience foods has climbed from 4.4% in 2018 to 7.6% in 2019, and this figure is still rising.

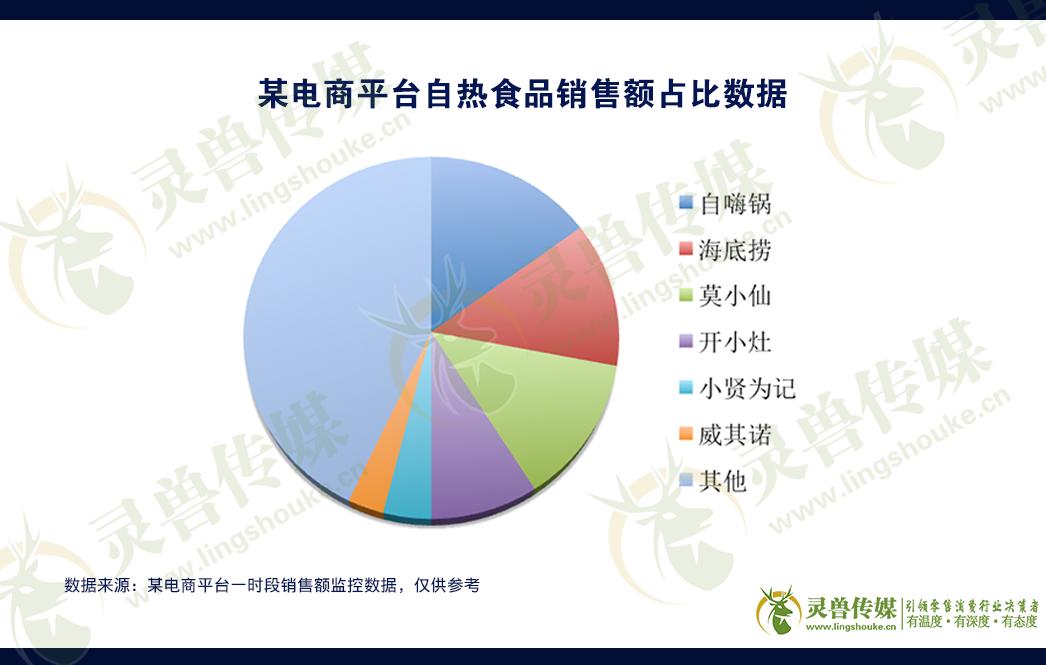

Although there are many incoming players, most of the market share is still in the hands of several "big players".

At present, the categories of self-heating food are mainly self-heating hot pot and self-heating rice, while self-heating barbecue, grilled fish and rice noodles have not yet gained a large market share.

According to the types of enterprises, self-heating food players can be subdivided into four branches: cutting-edge brands, catering brands, leisure snacks and convenience foods.

Cutting-edge brands are represented by self-hi pot, Mo Xiaoxian, chopsticks fashion, etc. In the early stage, they achieved rapid development through "OEM" production mode; Catering brands mainly rely on the original supply chain to transform the technology and taste of new products, such as Haidilao and Xiaolongkan, which are well known to the public. Snack food has snack companies such as good shops and three squirrels, and it has played a role in marketing planning.

The convenience food enterprises such as Uni-President, Master Kong and Jinmailang are "experts" of convenience food themselves, and this time they have also broadened the categories of convenience food through their own industrial chains.

People in the industry believe that there is no one type of enterprise with obvious advantages at present. For traditional convenience food enterprises, apart from their own productivity advantages, if they have the marketing ability of cutting-edge brands and the level of taste control of catering brands, there will be great room for expansion in the later stage.

Of course, few enterprises are "out of the circle" only by relying on their original advantages. For example, the brand of "opening a small stove" under Uni-President is one of the successful cases of "traditional enterprise+new marketing model"-the revenue in the first half of 2020 exceeded 170 million, a year-on-year increase of over 15 times.

It is understood that self-heating rice is the main product for cooking small stoves, and the category of self-heating hot pot is also being introduced one after another, and the product pricing ranges from 25 to 38 yuan.

As for brand endorsement, Sean Xiao, the top traffic star, was chosen by Kaixiaozao. In the "traffic wars" of many self-heating food enterprises, he used the fan logic of "buy = support" to enjoy a wave of "fan economy" dividends and successfully created the explosive product of self-heating rice.

"It is difficult to copy the model of explosive products with small stoves. It may be one of the most successful brands in terms of traffic at present, but it does not have an advantage in terms of price and production capacity, and it has not been well known and accepted by core consumers other than fans. This is a serious problem." Experts said.

According to "Spirit Beast", in 2020, the goods in Tmall flagship store are often in a state of tight inventory.

Kai Xiaozao believes that the competition in the self-heating food market is becoming increasingly fierce, and self-heating food, as a long-term development convenience food category, is more important to enhance product strength than capacity expansion.

Cai Hongliang, the founder of the self-cooking pot brand, said in an interview that "in the future, the self-cooking pot should still focus on the deep cultivation of product strength, start the construction of automated technology factories, further improve the iterative speed of production processes and products, and strengthen the core barriers of enterprises."

Everyone should strengthen product strength. What is "product strength"?

Product marketing experts believe that product power is "the ability of products with positive value to be expressed through channels, and to meet consumers’ desires and needs, so as to make them want to buy."

In short, in the field of self-heating food, how to satisfy consumers’ appetite is very important.

However, according to Spirit Beast, at present, a large part of self-heating food brands on the market are still assembled by "OEM" mode. That is to say, the seasonings, ingredients, heating packages and packaging of self-heating food are processed by various factories, and the brands are finally integrated. Compared with "food vendors", many self-heating food brands are more like an assembler.

It is precisely because self-heating products have low technical barriers and are easy to be copied, so large and small food enterprises want to share a piece of the action.

The consequence of this is that for a long time, consumers feel that different brands of products have very similar tastes.

In contrast, the unique taste of the self-help pot is its main advantage.

It is understood that there are more than 100 kinds of SKUs in the self-heating pot, mainly self-heating hot pot and self-heating rice. Since the commodity went on the market in January 2018, the sales in that year exceeded 100 million, increased to 500 million yuan in 2019, and is expected to exceed 1 billion yuan in 2020.

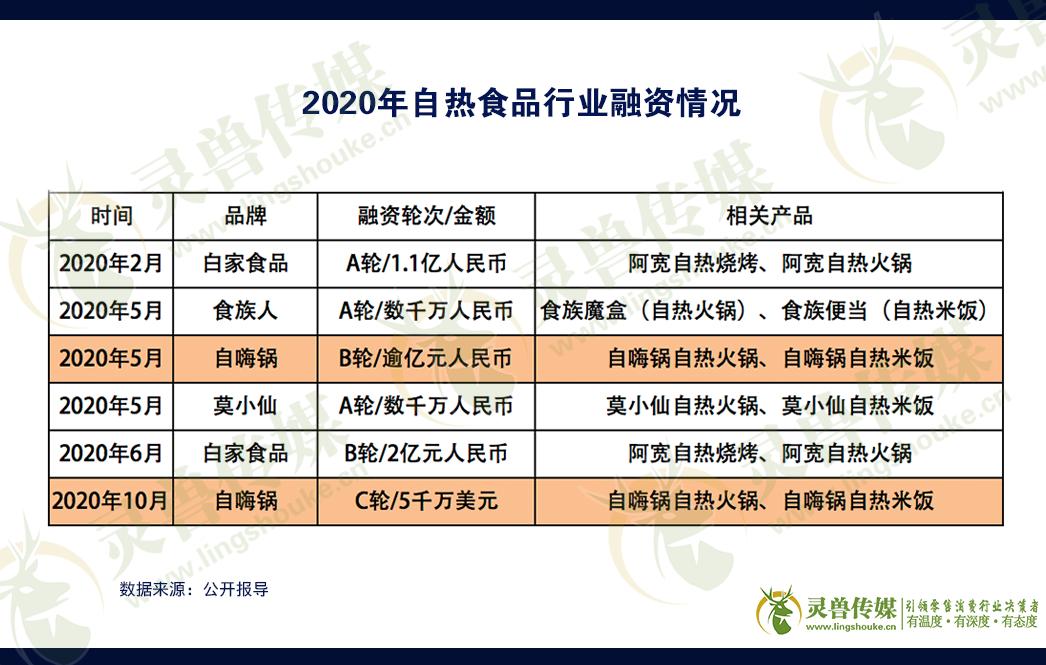

At the same time, in just over three years, it has completed three rounds of financing, with a valuation of over 500 million US dollars, becoming one of the "big winners" in the rise of the self-heating food industry.

Interestingly, some consumers once thought that "self-heating food" was "self-cooking pot" and took the brand name of self-cooking pot as the brand name.

According to the introduction of the pot, the company has its own taste research and development center since its establishment. In 2020, the new round of financing will also be mainly used for deepening the product strength and strengthening the construction of the upstream supply chain, and gradually realize its own production.

However, self-cooking pot consumables (consumables) and staple food materials (rice, etc.) are still processed by other foundries.

Some experts also pointed out that at present, the category of self-heating rice in self-cooking pot has formed advantages different from other brands in taste and price, but according to the development direction of self-cooking pot (building scientific and technological chemical plants and improving production capacity), how to strengthen quality control in the future is the key to development.

Because the explosion of enterprise sales requires a rapid increase in production capacity, which requires the simultaneous improvement of management capabilities, otherwise it is easy to make mistakes in quality control.

One more thing, one of the important reasons why self-heated food can "suddenly emerge" is that it has hit the pain point of "unhealthy instant noodles" in consumer cognition, so keeping the threshold of "quality control" is the most important thing in the future.

According to the data of upstream factories, the gross profit margin of self-heating hot pot is extremely high, and the cost is mostly between 10 yuan and 15 yuan, while the retail price is generally higher than that of 25 yuan, and the profit is nearly doubled.

Indeed, the low technical difficulty and high gross profit margin of self-heating food is one of the important reasons for attracting a large number of food enterprises and capital to flood into the track.

At present, some players who entered the game earlier have obtained the support of capital. In the future, the development of self-heating food industry is more likely to fall into the cycle of "brand rise, capital investment, brand strengthening barriers, and capital follow-up".

All in all, there are not many opportunities left for new players. Fortunately, the self-heating food track is still in the incremental market, and there is no leading brand so far.

The data shows that the size of China’s convenience food market exceeded 450 billion yuan in 2019. With the popularity of self-heating food and snail powder, it is estimated that the size of the convenience food market will reach 481.2 billion yuan in 2020. Among them, the self-heating food market is also expected to increase from 3.5 billion yuan in 2019 to 4.2 billion yuan.

According to the forecast of GF Securities, the self-heating food industry will reach the market space of 15 billion yuan in the next 5-7 years.

Experts believe that these increments mostly exist in the development of sinking market, the increase of application scenarios and the expansion of target groups.

According to the Insight Report of Instant Food Industry in 2021 released by the First Financial Business Data Center, the proportion of instant food products in first-and second-tier cities in China is over 60%. However, the market share of self-heating food in first-and second-tier cities will only be higher, and there is still a large blank area in the sinking market.

On the other hand, the report shows that the five major scenes that constitute the new trend of instant food consumption are "one person to eat", "family to eat", "new snack economy", "outdoor scene" and "dormitory sharing".

At present, the customer groups of self-heating food are mainly post-85, post-90 and post-95, a large part of which is because the application scenarios of self-heating food are still more applied to "office" or "home".

However, in the view of Chen Yuefeng, the founder of Spirit Beast, "the elderly group neglected by many industries and brands may have greater consumption potential in the future."

This is because the aging of the population has become an inevitable development trend in China, and this group of people have more or less the difficulty of mobility and the mentality of pursuing simple and healthy food needs.

We have to admit that self-heating food is an "evolutionary version" of instant noodles and other fast food, and it has solved the pain point of convenience food "health" to a certain extent, allowing consumers to "see" the cooking process of rice, deepening the concept of food health and increasing the "fireworks" of convenience food.

Recently, Kaixiaozao and Sanjiu Weitai jointly launched the "Angelica Pork Belly Chicken" self-heating rice, which raised the concept of "health" of self-heating food to a higher level, and some consumers suddenly thought of adding raw eggs, vegetables and other ingredients to self-heating rice, which not only ensured nutrition, but also enhanced the fun of "cooking".

However, "at present, the self-heating food industry is still in the early and middle stages of development, and there is still a certain distance from the requirements of the elderly in terms of food health and safety and nutritional collocation." Chen Yuefeng said.

Therefore, if self-heating food can really "break through" the demand defense line of the elderly and become a "home necessity" for the elderly in the future, self-heating food may also usher in a bigger and longer explosive "out of the circle".

So, for a group of self-heating food brands, who is the lucky darling?