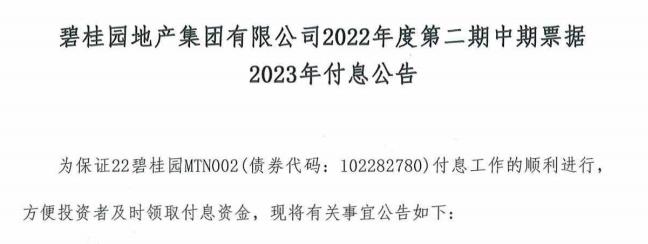

On December 19th, 2023,Real estate issues bondsIt is said that the second phase of the company’s medium-term notes in 2022 (referred to as "22MTN002") is intended to pay interest on December 26, 2023.

ShanghaiThe reporter noted that the real estate department is an affiliated company of Country Garden. Recently, Country Garden Real Estate has paid the bonds due as scheduled, and tried to ease the liquidity pressure by selling assets.

Advance bond interest payment

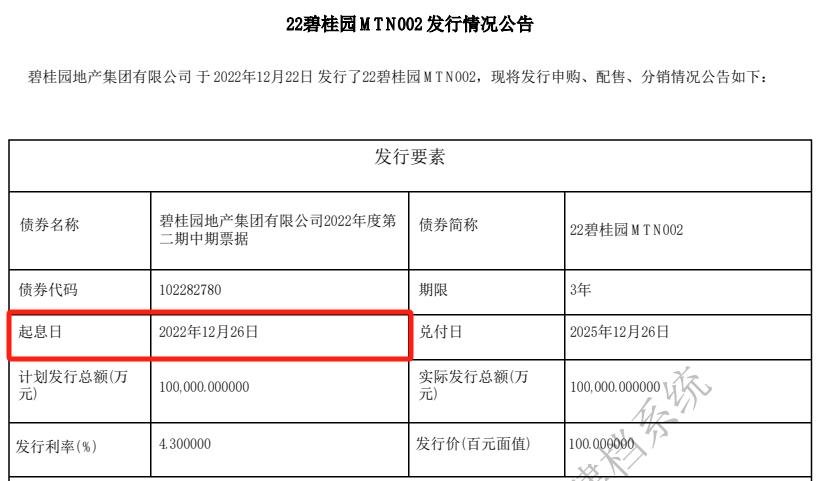

On December 26th, 2022, Country Garden Real Estate completed the issuance of 22 Country Garden MTN002, with a total bond issuance of 1 billion yuan and a coupon of 4.3%. The redemption date was December 26th, 2025.

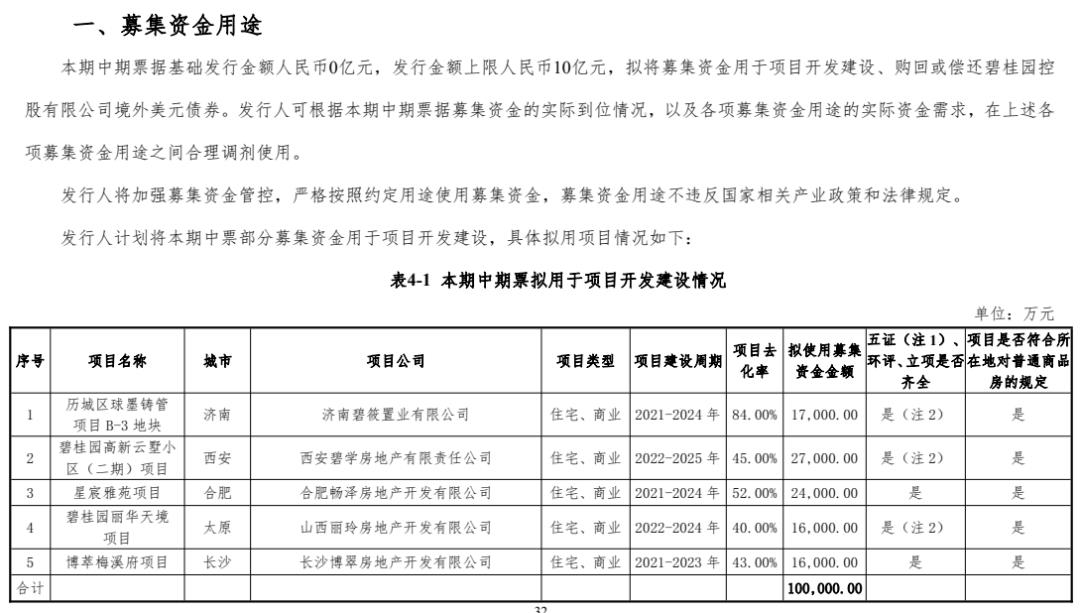

According to the prospectus, Country Garden Real Estate intends to use the raised funds for project development and construction, and to buy back or repay the overseas US dollar bonds of Country Garden Holdings Limited.

In terms of interest payment method, Country Garden Real Estate stated in the announcement on December 19, 2023 that the interest payment funds for debt financing instruments entrusted to Shanghai Clearing House will be transferred by the issuer to the collection account designated by Shanghai Clearing House before the specified time, and then transferred by Shanghai Clearing House to the bondholders on the interest payment date.Account.

The existing bonds have been redeemed.

Previously, Country Garden Real Estate paid the bonds due as scheduled.

On the evening of December 13th, 2023, Country Garden Real Estate issued a notice on the resale results of "22 Bidi 02" bondholders, saying that the principal and interest of some bonds sold back by "22 Bidi 02" had been paid in full, and the effective resale amount during the resale registration period was 800 million yuan.

According to Country Garden Real Estate, the bondholders of "22 Bidi 02" have the right to register during the investor resale registration period (from November 22, 2023 to November 28, 2023) and resell all or part of the bonds held in this period to the issuer at the resale price of 100 yuan/piece (excluding interest).

According to the data of Shenzhen Branch of China Depository and Clearing Co., Ltd., the number of effective resale declarations of "22 Bidi 02" during this resale registration period is 8 million, and the resale amount is 800 million yuan (excluding interest); Cancellation of the resale quantity of 0 pieces, cancellation of the resale amount of 0 yuan; After the cancellation of the repurchase, the remaining unsold bonds are 0.

Country Garden Real Estate decided not to resell the resale bonds. Country Garden Real Estate said that the principal and interest of some bonds sold back by "22 Bidi 02" had been paid in full to the account designated by CSI Shenzhen Branch, and "22 Bidi 02" was delisted on the Shenzhen Stock Exchange on December 14th.

Associated companies are constantly moving.

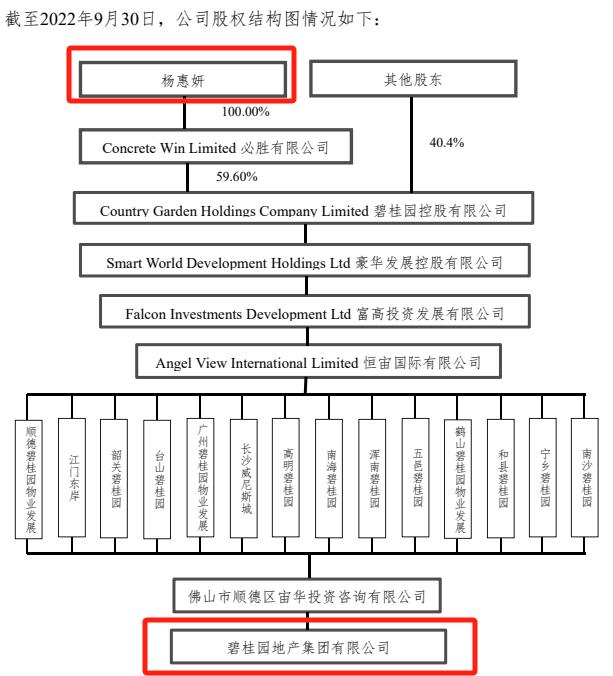

According to the equity penetration, Country Garden Real Estate is an affiliated company of Country Garden, and the actual controller is Yang Huiyan.

Recently, Country Garden sold assets to ease liquidity pressure.

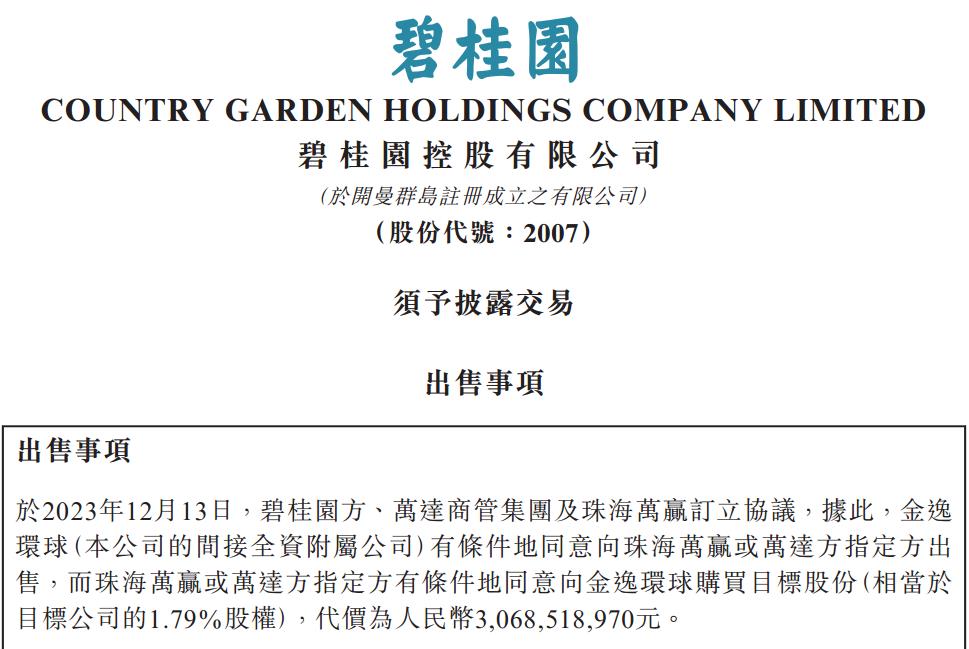

On December 14th, Country Garden announced that Jinyi Global Co., Ltd., an indirect wholly-owned subsidiary of the company, intends to sell its 1.79% equity of Zhuhai Wanda Commercial Management Group Co., Ltd. at a price of about 3.069 billion yuan.

However,Impairment of assets.

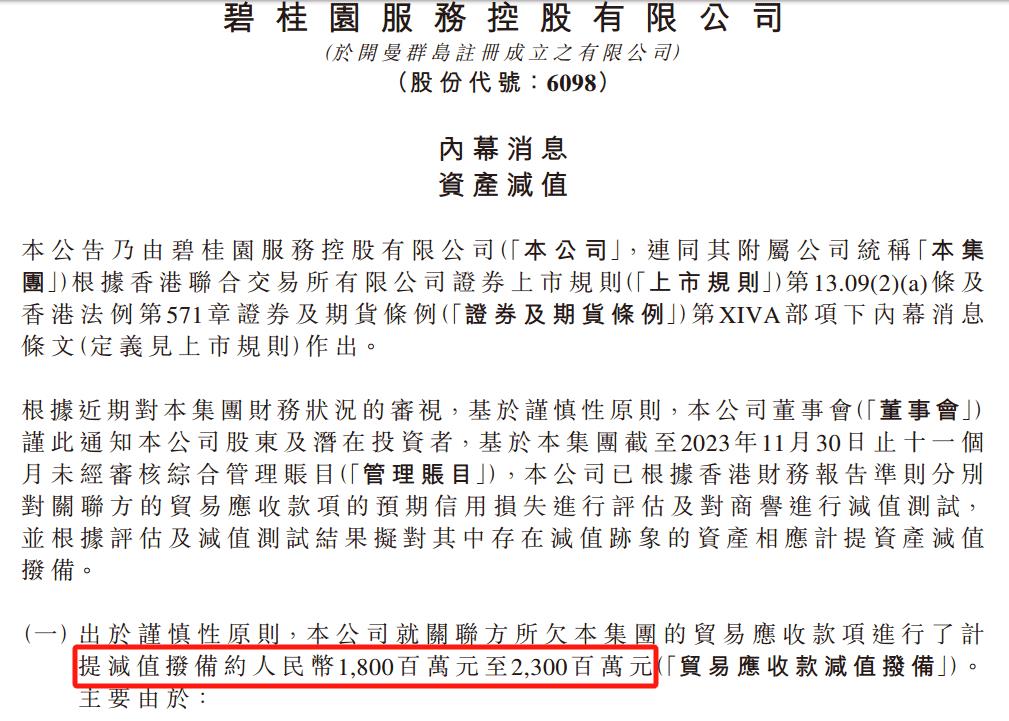

On December 18th, it was announced that, based on the management accounts, the company estimated that in the fiscal year ending December 31st, 2023,Due to the expected recognition of impairment provision for trade receivables and impairment of goodwill and other intangible assets, it will decrease by about 3.2 billion yuan to 4.1 billion yuan.

According to the announcement,Related party customers of the company are engaged inAnd related businesses are facing phased liquidity pressure. Based on the principle of prudence, the company made a large provision for impairment of trade receivables of related parties..

Among them, based on the unaudited comprehensive management accounts for the 11 months up to November 30, 2023, Country Garden Services has separately assessed the expected credit loss of related party trade receivables and conducted impairment test on goodwill in accordance with Hong Kong Financial Reporting Standards, and based on the results of the assessment and impairment test, it is proposed to make corresponding provision for asset impairment for assets with signs of impairment.

Country Garden Service has made provision for impairment of trade receivables owed by related parties to the company, ranging from 1.8 billion yuan to 2.3 billion yuan.

According to the progress of related party receivables recovery, Country Garden Service has actively adjusted the related business strategies of related parties, and the business scale of related parties has decreased compared with that of 2022, and it has kept close communication with related parties and tried its best to continuously promote the implementation of various trade receivables recovery measures.

On December 19th, Country Garden Services, a Hong Kong stock, fell more than 11% to HK$ 6.11 per share.

The three-minute announcement every day is very light.loose

The company donated 15 million yuan to Gansu Charity Federation for earthquake relief;IsomorphicShares;: Some directors raised the lower limit of holding shares; A group of companiesDisclosure of increase plan …

Watch today

▼ Focus 1:: The company donated 15 million yuan to Gansu Charity Federation for earthquake relief.

The company donated 15 million yuan to Gansu Charity Federation for earthquake relief work of Jishishan M6.2 earthquake.

▼ Focus 2: Wait for the shares to be repurchased

: The company intends to use its own funds to buy back some of the company’s shares in a centralized bidding transaction, which will be used for the employee stock ownership plan or. The total amount of repurchase funds is not less than 50 million yuan, not more than 100 million yuan, and the repurchase price is not more than 26.3 yuan/share.

The company intends to use its own funds to buy back some shares of the company’s public shares by centralized bidding, which will be used to cancel and reduce the registered capital. The total amount of repurchase funds is not less than 30 million yuan, not more than 50 million yuan, and the repurchase price is not more than 8.10 yuan/share.

The company intends to buy back the company’s shares with its own funds through centralized bidding transactions, and use them for planning at an appropriate time in the future. The price of this share repurchase is no more than 9.00 yuan/share, and the total amount of repurchase funds is no less than 30 million yuan and no more than 50 million yuan.

▼ Focus 3:: Some directors raised the lower limit of holding shares.

The company previously announced that the directors (excluding independent directors), supervisors (excluding external supervisors) and senior managers who were in office as of August 4 actively increased their holdings of the company’s shares by not less than 10% of the total after-tax remuneration received from the company in the previous year on the trigger date, that is, the total amount of actively increased holdings of the company’s shares was not less than 1,376,400 yuan. Recently, in order to further show confidence in the company’s future development prospects and recognition of the company’s long-term investment value, the above-mentioned relevant personnel voluntarily raised the total amount of actively increasing the company’s shares to not less than 1.3764 million yuan to not less than 3.5 million yuan.

Fixed increase &

The company intends to issue no more than 39 million shares of the company to a specific target by a summary procedure. It is estimated that the total amount of raised funds will not exceed 250 million yuan (inclusive), and the net amount of raised funds after deducting the issuance expenses will be used for Zhengyuzhi Gardening Project.

material particulars

Recently, the company received the notice of the pre-transaction result of Shenglong Mining Group’s capital increase and share expansion project, and confirmed and established the equity investment of Financial Assets Investment Co., Ltd. and Zhongyuan Qianhai.(Limited Partnership), Baowu Green Carbon Private Investment Fund (Shanghai) Partnership (Limited Partnership) and Luoyang State-owned Assets Management Co., Ltd. are investors in this capital increase and share expansion project of Shenglong Mining Group, with a total planned investment of 680 million yuan. The company will subscribe for 16,393,442 new shares with its own funds of RMB 50 million at a subscription price of RMB 305 per share. After the completion of this capital increase, the company will hold 1.0113% equity of Shenglong Mining Group.

: Shenneng, a wholly-owned subsidiary of the company.64% equity of Kelan Jingneng held by Shanxi Jingneng was transferred, and the transaction price was subject to the recorded appraisal value. After the transaction is completed, Shenneng holds 64% equity of Kelan Jingneng, and Shanxi Jingneng holds 36% equity of Kelan Jingneng. Kelan Jingneng owns the 100MW forest-light complementary project of Jingneng in kelan county, which was connected to the grid with full capacity in October 2023.

The company plans to set up a project company to promote the 50MW wind power project in xinji city. The registered capital of the project company is 65 million yuan, which is 100% contributed.

: The company plans to acquire 65% and 35% equity of Qinghai Hongxin held by Yuntong Group and Yuntong Zinc Industry respectively in cash of RMB 1,092,361,900. After the acquisition is completed, the company will directly hold 100% equity of Qinghai Hongxin, and Qinghai Hongxin will become a wholly-owned subsidiary of the company and be included in the company’s consolidated statements.

: Hengwei Intelligent, a wholly-owned subsidiary of the company, andSign the Purchase Order,The total amount is RMB 546 million. This contract is a procurement contract that has been implemented after Hengwei Intelligent won the bid for the "Procurement Project of All-in-One AI Computing Machine".

: Yunneng Capital, a shareholder of the company, transferred its 1,000,000,000 shares (accounting for 5.56% of the company’s total share capital) to its two wholly-owned subsidiaries, Yunneng Industry and Finance, of which 720,000,000 shares (accounting for 4% of the company’s total share capital) were transferred to Yunneng Industry and 280,000 shares were transferred to Yunneng Industry. After the transfer is completed, Yunneng Investment will no longer directly hold the company’s shares. This change in shareholders’ equity belongs to the free transfer of state-owned assets and does not touch the tender offer.

In November 2023, the company’s total revenue from express logistics business, supply chain and international business was 23.608 billion yuan, a year-on-year increase of 5.78%; In November, the revenue and business volume of Express Logistics excluding Fengwang increased by 18.86% and 24.08% respectively.

: In November 2023, the company’s express service revenue was 4.586 billion yuan, a year-on-year increase of 7.60%; The business volume was 1.93 billion votes, a year-on-year increase of 30.41%; The single ticket revenue of express service was 2.38 yuan, down 17.36% year-on-year.

: In November 2023, the company’s express delivery service revenue was 3.969 billion yuan, a year-on-year increase of 25.39%; The business volume was 1.802 billion votes, a year-on-year increase of 49.20%; The single ticket revenue of express service was 2.20 yuan, down 16.03% year-on-year.

: The company intends to purchase all assets of TESA Group held by Hexagon, including 100% equity of Tesa Sarl and related assets of China, the United States and French companies, with a transaction price of no more than 40 million euros. This transaction intends to use the company’s previous issuance.The funds raised shall be raised by the company itself. The company said that the acquisition is aimed at layout.μ-level high-precision measuring tools necessary for parts processing, improve the company’s existing product line and expand industrial-grade product customers.

Hunan Hualing Xiangtan Iron and Steel Co., Ltd., a subsidiary of the company, plans to increase its capital by 30 million US dollars to its wholly-owned subsidiary Hunan Hualing Xiangtan Iron and Steel (Singapore) Co., Ltd. After the capital increase is completed, the registered capital of Valin Xianggang Singapore Company will increase to USD 35 million.

Baoding Electric Power, a wholly-owned subsidiary of the company, plans to invest in the second phase of Shenneng Baoding Northwest Suburb Thermal Power Plant. The total investment of the project is 3,026.17 million yuan, of which its own funds are 605 million yuan, and the rest of the investment funds are planned to be solved through financing. In view of the current financial situation of Baoding Electric Power, it is planned that the company will increase the capital of Baoding Electric Power by 605 million yuan for this project. After the capital increase, the registered capital of Baoding Electric Power will increase from 991,443,600 yuan to 1,596,443,600 yuan.

: On December 17th, 2023, the company received a notice from the company’s actual controller, who was planning the transfer of control rights. Since the company’s stock opened on December 18, 2023,. On December 19, 2023, the company received a notice from the actual controller, and the change of the company’s control rights was still in the stage of further discussion. After the company applied to Shenzhen Stock Exchange, the company’s shares were suspended from trading on December 20, 2023. The expected suspension time is three trading days.

The company decided to terminate the issue of convertible corporate bonds to unspecified objects and applied to Shenzhen Stock Exchange to withdraw the relevant application documents.

The company and Jiangxi Black Cat Carbon Black Co., Ltd. have carried out strategic cooperation in product development, market application, downstream promotion and technological innovation of domestic high-performance materials such as wet mixing composite masterbatch and high-performance carbon black. Both parties are willing to jointly build a long-term, close and comprehensive strategic cooperative relationship, and both parties reached a consensus through friendly negotiation and signed the Strategic Cooperation Framework Agreement.

The company signed a strategic cooperation framework agreement with Jiangsu Academy of Agricultural Sciences, and reached an agreement on matters related to the joint construction of "Jiangsu Academy of Agricultural Sciences Yike Meat and Poultry Industry Research Institute". The two sides will focus on meat and poultry seed industry, feed nutrition, disease prevention and control, breeding mode, manure recycling, intelligent equipment, poultry meat processing,All-round cooperation will be carried out to meet the technical needs of the whole industry chain, and a green, industrialized and intelligent technical system for meat and poultry will be built.

Recently, Zhejiang Petrochemical Co., Ltd., a holding subsidiary of the company, invested and built a 380,000-ton/year polyether plant in Zhoushan Green Petrochemical Base, and the 240,000-ton/year PPG production line has produced qualified products.

Recently, the company received the Notice of Approval for Drug Supplement Application for Doxazosin Mesylate Sustained-release Tablets approved by National Medical Products Administration, and the company’s Doxazosin Mesylate Sustained-release Tablets passed the consistency evaluation of generic drug quality and efficacy. The indications of doxazosin mesylate sustained-release tablets are: symptomatic treatment of benign prostatic hyperplasia; High blood pressure.

Increase or decrease holding

: The controlling shareholder of the company, Electrochemical Group, intends to adopt the methods allowed by the Shanghai Stock Exchange system within 12 months from the disclosure date of this announcement (including but not limited to centralized bidding transactions,Etc.) Increase the company’s A shares by not less than 15 million yuan and not more than 30 million yuan.

On December 19th, Chen Wangming, the director of the company, increased his holding of 100,000 shares of the company by centralized bidding through the trading system of Shanghai Stock Exchange, with an increase of 659,000 yuan. Wu Xiujiao, the company’s director, vice president and chief financial officer, increased his holding of 10,000 shares by centralized bidding through the trading system of Shanghai Stock Exchange, with an increase of 65,000 900 yuan.

Huanong Assets, the concerted action of the company’s actual controller, increased its holding of 924,058 shares of the company through the trading system of Shanghai Stock Exchange on December 19, 2023, accounting for 0.09% of the total share capital.

: The controlling shareholder and actual controller of the company, and some directors plan to increase their holdings of the company’s shares by means of their own or self-raised funds (including but not limited to centralized bidding and block trading, etc.), with a total increase of not less than 5.5 million yuan.

Chen Jianxiang, the actual controller of the company, plans to increase the company’s shares from the secondary market within six months, with an increase of not less than 2 million yuan and not more than 4 million yuan. There is no price range for this increase.

stop

Resumption of trading:(000796)、(002482)。

Suspension: Not yet.