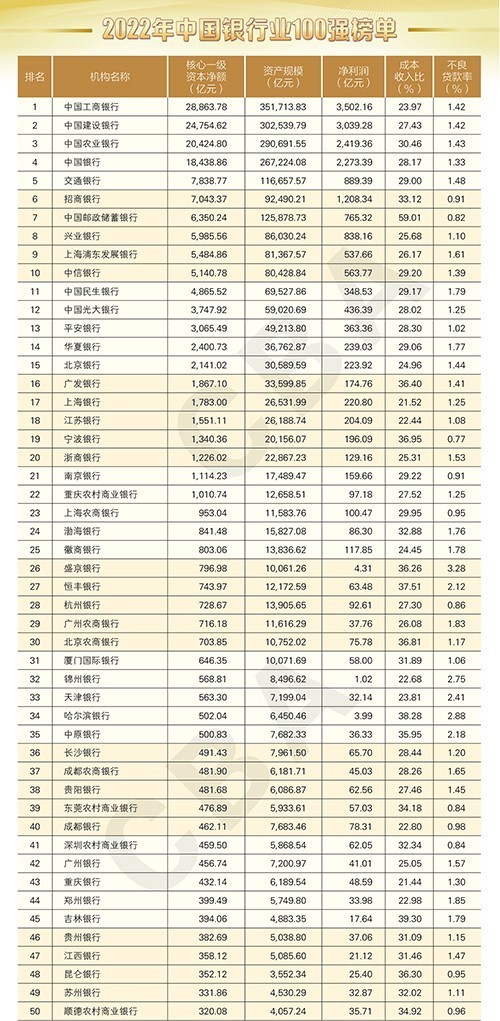

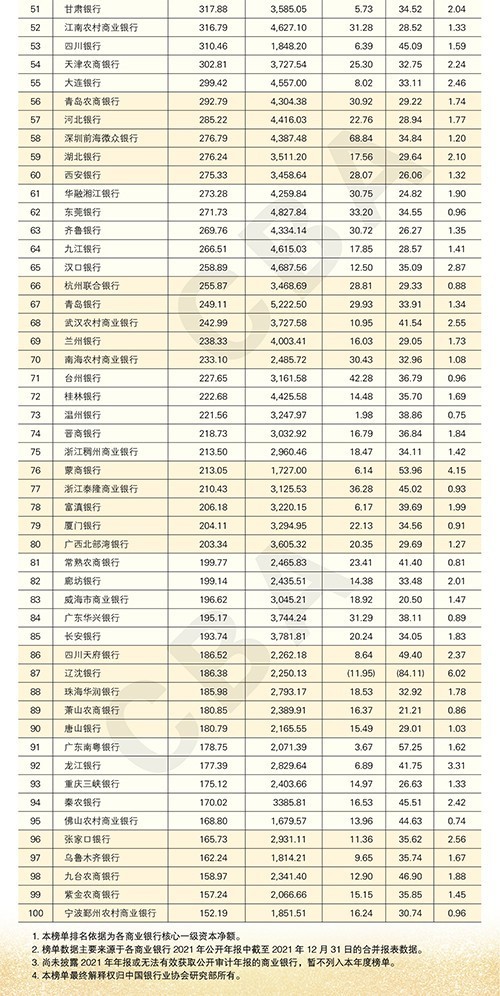

China Net Finance June 21st (Reporter Zeng Qiang) The China Banking Association (hereinafter referred to as "BOC Association") released the "Top 100 Banking Companies in China in 2022" yesterday. It is reported that this is the seventh consecutive year that the China Banking Association has released the list, which follows the principle of simplicity, objectivity and professionalism, refers to Basel III and the relevant requirements of the regulatory authorities, and ranks by the net core tier 1 capital, and comprehensively displays the operation scale, profitability, operational efficiency and asset quality of the top 100 banks in China. The list data mainly comes from the public annual reports of commercial banks, and covers all types of Chinese commercial banks. In 2021, the total assets of listed banks accounted for 89.67% of the total assets of commercial banks, creating 96.84% of the net profit of commercial banks, including 6 large banks, 12 joint-stock banks, 60 city commercial banks, 21 rural commercial banks and 1 private bank.

China Net Finance reporter combed, compared with the "Top 100 Banking Companies in China in 2021" released by the Bank of China Association in July 2021, among the 100 commercial banks shortlisted in the "Top 100 Banking Companies in China in 2022", 33 banks have maintained their rankings, and the number has increased by 8 compared with 2021; The ranking of 31 banks has risen, and the number has increased by 9 compared with 2021; There are 33 banks ranked backward, with 17 fewer than in 2021. At the same time, three new banks entered the list, and the number was the same as that in 2021.

(Source: China Banking Association WeChat WeChat official account)

Specifically, the ranking of the top 18 banks in the list released this time has not changed from that in 2021, and the ranking order is: Industrial and Commercial Bank of China, China Construction Bank, Agricultural Bank, Bank of China, Bank of Communications, China Merchants Bank, Postal Savings Bank, Industrial Bank, Shanghai Pudong Development Bank, China CITIC Bank, Minsheng Bank, China Everbright Bank, Ping An Bank, Huaxia Bank, Beijing Guangfa Bank, Shanghai Bank and Jiangsu Bank. The remaining 15 banks with unchanged rankings are: a stock bank in hengfeng bank; 11 city commercial banks including Nanjing Bank, Xiamen International Bank, Jinzhou Bank, bank of tianjin Bank, Harbin Bank, Zhongyuan Bank, Hubei Bank, Xi ‘an Bank, Huarong Xiangjiang Bank, Dongguan Bank and Xiamen Bank; Nanhai Rural Commercial Bank, Qingdao Rural Commercial Bank and Chongqing Rural Commercial Bank.

Among the 31 banks with rising rankings, Wenzhou Bank jumped the fastest, rising from 21 to 73; Followed by Weizhong Bank, which rose 13 places to 58th place. This is the second consecutive year that Weizhong Bank rose by more than 10 places, and in 2021 it rose by 12 places to 71st place. The remaining 29 banks that rose in the rankings were Hankou Bank, which rose by 8 places; Shenzhen Rural Commercial Bank and Zhejiang Tailong Commercial Bank rose by 7 places; Guangdong Huaxing Bank and Xiaoshan Rural Commercial Bank rose by 6 places; Taizhou Bank rose by 5 places; Changsha Bank, Dongguan Rural Commercial Bank and Qilu Bank rose by 4 places; Bank of dalian and Zhejiang Chouzhou Commercial Bank rose by 3 places; Shanghai Rural Commercial Bank, Suzhou Bank, Shunde Rural Commercial Bank, Jiangnan Rural Commercial Bank, Guangxi Beibu Gulf Bank, Changshu Rural Commercial Bank and Changan Bank rose by 2 places; Bank of Ningbo, Huishang Bank, Hangzhou Bank, Guangzhou Rural Commercial Bank, Guiyang Bank, Chongqing Bank, Wuhan Rural Commercial Bank, Zhuhai China Resources Bank, Urumqi Bank, Jiutai Rural Commercial Bank and Zijin Rural Commercial Bank rose by one place.

Among the 33 banks that have fallen back in ranking, Guangdong Nanyue Bank has the biggest decline in ranking, falling 11 places from the 80th to the 91st. The remaining 32 banks ranked backward were Jiujiang Bank and Langfang Bank, which retreated 7 places; Longjiang Bank retreated 6 places; Guangzhou Bank retreated 5 places; Jilin Bank, Guilin Bank and Zhangjiakou Bank retreated 4 places; Sichuan Bank, Hangzhou United Bank, Qingdao Bank and Lanzhou Bank retreated three places; Shengjing Bank, Beijing Rural Commercial Bank, Chengdu Bank, Bank of Zhengzhou, Gansu Bank, Hebei Bank, Jinshang Bank, Mongolian Commercial Bank, Weihai Commercial Bank, Tangshan Bank, Chongqing Three Gorges Bank and Foshan Rural Commercial Bank retreated two places; Zheshang Bank, Bohai Bank, Chengdu Rural Commercial Bank, Guizhou Bank, Jiangxi Bank, Kunlun Bank, Tianjin Rural Commercial Bank, Fudian Bank and Sichuan Tianfu Bank retreated by one place.

It is worth noting that in the list of the top 100 banks in China in 2022, three banks, Liaoshen Bank, Qinnong Bank and Ningbo Yinzhou Rural Commercial Bank, were newly added to the list, among which Qinnong Bank returned again and fell off the list in 2021.