Produced by | sohu finance

Author | Gai Jiaoyi

On March 24th, Liangpin Store released its 2022 financial report. Last year, the revenue of good shops was 9.44 billion yuan, a year-on-year increase of 1.24%; The net profit of returning to the mother was 340 million yuan, a year-on-year increase of 19.16%.

In 2022, the main business income of good shops was 9.319 billion yuan, an increase of 1.91% over the same period; The gross profit margin of the company’s main business was 27.67%, up 0.69 percentage points over the same period.

In 2022, the online income accounted for 50.42%, the offline income accounted for 49.58%, and the online income decreased by 2.71 percentage points year-on-year.

In 2022, 661 new stores were opened in Liangpin shops, including 166 direct stores and 495 franchised stores. As of December 31, the total number of offline stores in Liangpin Shop was 3,226.

Revenue reached an all-time high, with gross profit margin and net interest rate lower than Yanjin Puzi.

Last year, the revenue of good shops was 9.44 billion yuan, up 1.24% year-on-year, and the revenue reached its highest level since listing.

According to Huaxin Securities Research Report, the revenue of Liangpin Store in the fourth quarter of last year was 2.447 billion yuan, down 12% year-on-year, and the revenue in the fourth quarter was under pressure.

According to the disclosure, among the revenue of 9.44 billion yuan, the main business income was 9.319 billion yuan, an increase of 1.91% over the same period. Among them, online income accounted for 50.42%, and offline income accounted for 49.58%.

In 2022, good shops realized a net profit of 340 million yuan, a year-on-year increase of 19.16%; Realized a net profit of 210 million yuan, a year-on-year increase of 1.46%.

Last year, the revenue and net profit of good shops increased against the trend, which was inseparable from the good development of the leisure and snack industry.

According to the statistics of China Commercial Industry Research Institute, in 2022, the market space of generalized leisure snacks in China exceeded 1.5 trillion yuan, with a compound growth rate of over 10% in recent five years. According to Euromonitor international data, the market size of packaged leisure snacks in a narrow sense (excluding non-packaging and baking) reached 482.3 billion yuan, with a compound annual growth rate of 4.6% in the past five years, of which the compound annual growth rate of meat snacks was 9.3% and that of nut snacks was 6.1%, which was much higher than the industry market. The industry as a whole is in the middle and high-speed development stage, and opportunities for the development of new products and new categories are constantly emerging.

Competitors Three Squirrels, Yanjin Shop and Laiyifen will release their 2022 financial reports on April 26th, March 31st and April 27th respectively.

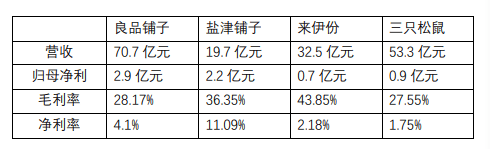

Comparing the published data of the first three quarters of 2022 with the four leisure snack enterprises, it is found that the good shop has the most revenue, the gross profit margin in Iraq is the highest, and the net profit margin in Yanjin shop is the highest. among

According to the three quarterly reports of four companies in 2022, sohu finance is organized as follows:

In 2022, the gross profit margin of 27.67% of good shops was lower than the average of the four stores.

Liangpin Store mentioned in the financial report that the company’s main raw materials include nuts, fruits, meat, aquatic products, grains and other agricultural and sideline products, and the company’s procurement cost is at risk of changing with the market price fluctuation of agricultural and sideline products.

Sohu finance got a confirmation message from the good shop that "there is no factory at present". According to public information, the business model of good shops is "OEM+OEM", while Yanjin shops with better profitability belong to the "self-production and self-sales" model.

Zhu Danpeng, a food industry analyst in China, believes that self-built factories must be the future development direction of good shops. In addition, how to differentiate positioning and operation is also a key issue for leisure and snack enterprises in China.

Online and offline revenues each account for half, and 661 new stores were opened last year.

Online business contributed half of the total revenue, and both online and offline gross margins increased slightly.

The operating income of Liangpin Shop Company in 2022 was 9.44 billion yuan, of which the e-commerce business income was 4.70 billion yuan, accounting for 49.8% of the total revenue; The income from direct retail business was 1.56 billion yuan, accounting for 16.5% of the total income; The income from franchise business is 2.44 billion yuan, accounting for 25.8% of the total income.

According to the disclosure, the gross profit margin of the main business of Liangpin Shop was 27.67%, up by 0.69 percentage points over the same period, of which the gross profit margin of online channels increased by 0.40 percentage points and the gross profit margin of offline channels increased by 0.57 percentage points over the same period.

Sohu finance observed that online, in addition to the flagship stores of Tmall, JD.COM and Pinduoduo, Liangpin Store also opened a flagship store in Tik Tok, and now it ranks first in Tik Tok leisure snack shops, followed by Fumanpeng and three squirrels.

There are 1.419 million fans in the account of Liangpin Store’s flagship store in Tik Tok, and there are 13 products with sales exceeding 10,000. The highest sales volume is pork breast, with a total of 146,000 copies.

Offline, it is revealed that there were 661 new stores opened in Liangpin shops last year, including 166 direct stores and 495 franchised stores. By the end of the reporting period, there were 3,226 offline stores in 23 provinces/autonomous regions/municipalities and 181 cities.

According to the distribution of stores, good shops and stores are concentrated in Central China. In Central China, 1,462 stores accounted for 45.3%, in Southwest China, 567 stores accounted for 17.5%, and in South China, 390 stores accounted for 12.1%. The least is the North China market, with only 10 companies.

Zhu Danpeng believes that the online and offline channels of good shops each account for nearly half, which is a very balanced layout with strong anti-risk ability and is its moat.

In addition, the sales of products in good shops are also relatively balanced.

In 2022, other products accounted for the largest proportion of 23.2% with income of 2.16 billion yuan, and meat snacks accounted for 22.5% with income of 2.10 billion yuan; Candy and cakes accounted for 22.1% with 2.06 billion yuan; Nut roasted seeds and nuts accounted for 16.8% with 1.57 billion yuan, dried fruits and vegetarian delicacies accounted for 8.9% and 6.5% respectively.

By the end of last year, there were 1,655 omni-channel SKUs in good shops. In 2022, there were 603 SKUs of new products, including 17 new products with sales exceeding 10 million.

According to the disclosure, good shops invested 50 million yuan in research and development expenses last year, an increase of 27.45% compared with 2021. According to the 2022 performance forecast of Yanjin Shop, last year Yanjin Shop invested 74 million yuan in research and development.